5 Things Investors Should Know About China This New Year

Last Friday marked the first day of the Chinese Lunar New Year, also known as the Spring Festival, China’s most important holiday. The fire rooster struts off-stage, clearing the way for the loyal earth dog. According to CLSA’s tongue-in-cheek Feng Shui Index, health care, consumer and paper products are favored to outperform early this year, followed by internet, utilities and tech leading into the summer.

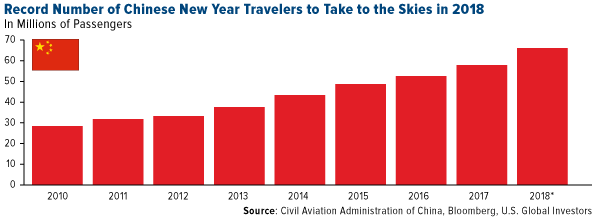

Around this time I always pay close attention to transportation and industrials. “Chunyun,” which translates to “Spring Festival Transportation,” is a 40-day travel season that’s known as the world’s largest human migration. This year, as many as 390 million Chinese travelers—more people than live in the U.S. and Canada combined—are forecast to put roads, highways, passenger trains and airlines through their paces as they visit families, go on vacation and travel abroad. Airlines alone are expected to serve 65 million passengers, a 10 percent increase from last year.

As the size of China’s middle class continues to surge and incomes rise, this upward trend in flight demand and overall consumer spending appears sustainable, creating some very attractive investment opportunities.

Below are five additional things I think investors should know about China and the surrounding region in the New Year.

-

China is a veritable wealth factory.

Speaking of disposable income: Last year, the China region added more new billionaires than the U.S. for the first time ever. UBS and PricewaterhouseCoopers’ (PwC) annual report on billionaires found that the total number of Asian billionaires rose to 637, followed by the U.S. (563) and Europe (342). China alone minted 67 new billionaires in 2017 and is now home to nearly 320.

Combine this with a surging middle class—already the largest in the world—and the consequences on consumption could be huge.

As I’ve shared with you before, China is still in the early stages transitioning from a manufacturing to a consumption and services-based economy. According to the World Economic Forum (WEF), Chinese household income is projected to grow around 5 percent annually between now and 2027, elevating approximately 180 million people into the middle-income bracket. This will contribute to greater demand for everything from appliances to smartphones to automobiles to luxury goods.

Gold jewelry demand, for instance, grew 10.35 percent year-over-year in 2017. And it wasn’t just the super wealthy making purchases, the China Gold Association reported. Less affluent consumers also had an appetite, helping China maintain its ranking as the world’s largest buyer of gold for the fifth straight year.

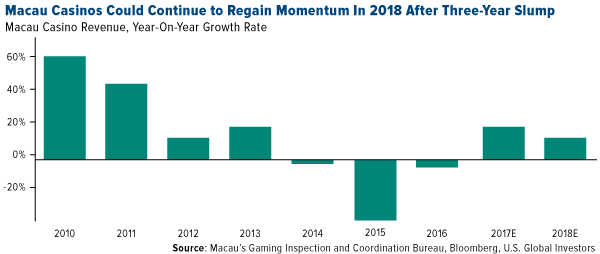

Heavier spending is also showing up in Macau casinos, which saw revenues jump an incredible 36.4 percent year-over-year in January. This was the gaming territory’s 18th straight positive month and its largest such increase in nearly four years, suggesting Macau is well on its road to recovery after Chinese president Xi Jinping’s anticorruption crackdown.

This month, Macau welcomed its newest casino resort, the $3.4 billion MGM Cotai, increasing MGM’s gaming table count in the territory nearly 30 percent to 552, according to Reuters.

-

But don’t count Chinese manufacturing out just yet.

Despite China’s de-emphasis on manufacturing as its main growth engine, a lot of value still remains. Chinese manufacturing began the year strong, expanding at a healthy clip with a purchasing manager’s index (PMI) reading of 51.3. This was down slightly from December but in-line with the previous January.

Expectations are especially high for electric vehicle (EV) production and sales, as the Chinese government sweetened the incentive for families to trade in their gas-powered automobile for one that runs on a battery-powered electric motor. Those with a range greater than 400 kilometers (249 miles) on a single charge now come with a 50,000 yuan ($7,881) cashback incentive, up from 44,000 yuan ($6,937) last year, according to Bloomberg. The government also increased the number of kilometers a car must be able to travel on a single charge to qualify for the incentive, from 100 last year to 150.

“Sales volumes for new-energy vehicles exceeded 700,000 last year, and this number is further expected to increase to more than 2 million in 2020, and to more than 5 million in 2025,” Kevin Li, a senior analyst with Strategy Analytics, told CNBC early this week.

Several Hong Kong-listed carmakers and their suppliers had a fabulous 2017. Guangzhou ended the year up 97 percent while Geely gained more than 265 percent. The government’s policy change appears to be another tailwind.

Robotics and artificial intelligence (AI) is another space that China is expected to dominate. According to UBS, China overtook the U.S. and Japan in 2016 in installed robotics systems, and by 2020 it’s set to manufacture up to 40 percent of all robots globally. By 2030, its AI industry could be worth as much as $150 billion.

-

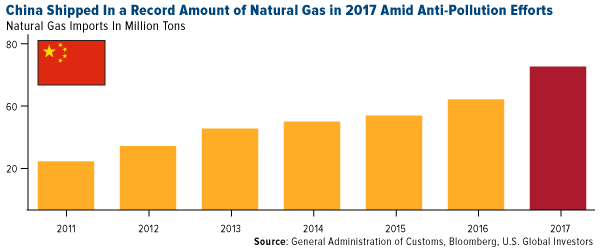

China has an insatiable appetite for energy, both clean and traditional.

As its generous incentive for EVs suggests, the Chinese government is serious about combating air pollution, especially in highly populated metro areas.

As such, the country imported a record amount of natural gas, which burns more cleanly than coal. According to customs data, China consumed 68.57 million metric tons of the fossil fuel in 2017, up 27 percent from the previous year.

That doesn’t mean the Asian giant is done entirely with other fossil fuels, though. The U.S. Energy Information Administration (EIA) reported last week that China imported more crude oil than the U.S. for the first time in 2017. It brought in an average 8.4 million barrels per day last year, compared to 7.9 million barrels per day for the U.S.

As I shared with you last week, China is now the largest consumer of U.S. crude oil other than Canada, according to Reuters.

-

Nearly 40 percent of the world’s unicorns call China home.

As you probably know, a “unicorn” is a company valued at more than $1 billion that hasn’t been listed yet. Think Uber, Dropbox, Airbnb and more.

A September report by Deloitte and China Venture found that China is home to 98 of the world’s 252 unicorns, accounting for 38.9 percent of the total number. Only the U.S. has more at 106 unicorns, or 42.1 percent.

Like U.S. unicorns, the ones in China come mostly from information technology, including online payment services and e-commerce.

Among the largest is smartphone-maker Xiaomi, which is valued at a whopping $100 billion. It, and several others, are highly anticipated to go public this year, with a showdown brewing between Hong Kong and New York.

According to CNBC, close to 140 Chinese companies raised $32.2 billion in initial public offerings (IPOs) in 2017, a figure that could be exceeded this year if Xiaomi, Uber-competitor Didi Chuxing, content platform ByteDance and more decide to list.

-

China hosts the most and biggest bitcoin mining facilities. But for how long?

Another Chinese unicorn that could be eyeing a possible IPO soon is Bitmain, the world’s largest manufacturer of bitcoin mining rigs. It also operates Antpool, a cryptocurrency “mining pool” that generates digital coins using the pooled resources of a number of different miners. The Beijing-based Bitmain, whose valuation is reportedly “in the billions,” claims to have built around 70 percent of all mining rigs in operation around the world today.

It’s little wonder, then, that three-quarters of bitcoins globally are mined in China, according to a 2017 University of Cambridge study. Mining concentration is especially high in the southwestern province of Sichuan, where miners have managed to strike deals with hydroelectric power companies.

“China is the country that hosts most mining facilities and uses the highest power consumption of all countries for cryptocurrency mining,” the study’s authors write.

That could soon change, however. The Chinese government has already clamped down on bitcoin exchanges and banned initial coin offerings (ICOs), and now it seeks to shutter the mines themselves. Last month, a governmental taskforce on internet finance asked local authorities to assist in shutting down operations that produce cryptocurrencies.

At the moment, there doesn’t seem to be a deadline, but miners are already scouting the world for new mining locations. Bitmain, which also has a presence in Switzerland, is looking at potential sites in energy-rich Quebec, according to Reuters, and other miners could be following suit.

I want to wish all readers a happy Lunar New Year! May the year of the earth dog bring you joy, health and prosperity! Check out our infographic, “5 Things to Know About the Chinese New Year.”

*********

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2017: Geely Automobile Holdings Ltd., Guangzhou Automobile Group Co.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at