The Janet Yellen Market Rally!

Currently, we are experiencing the SPX500 topping formation. Again, it is dangerously overextended. The SPX500 staged a strong rally due to the repeated actions of Central Bankers, during the month of February 2016.

Presently, we are truly living, investing and trading in 'unprecedented' times. Another push higher is not out of the question at this time, into 'nominal' new highs as we experienced this past Friday, April 1st. Consequently, within a week or two, it should start cycling back down.

There are strong 'headwinds' straight ahead for any attempted rallies that may take place. There is 'bearish' divergence within several momentum oscillators. This is signaling major warning signs! There are no bullish or favorable long set-ups in the market place environment. I would be alert for 'unexpected' choppy price movements across the board.

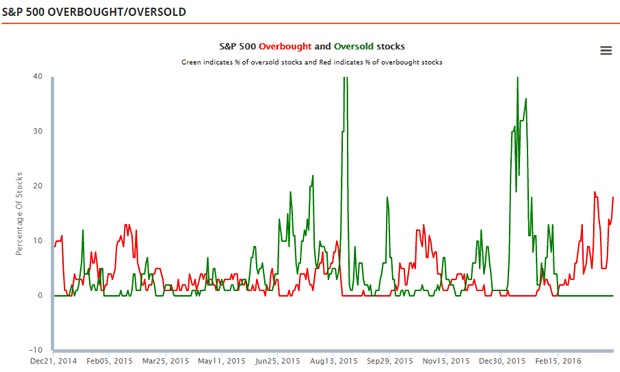

Investor sentiment has reading levels associated with 'peaks' in the equity market advances. Courtesy of ivewmakets.com

It is dangerous when the markets have nothing of substance sustaining them, other than their dependence on the FED's announcements regarding its monetary support. It is extremely dangerous when the FED tailors its remarks in order to support financial asset levels. This is not the mandate of the FED. However, we are all waiting with anticipation to hear their future announcement!

When Dr. Janet Yellen can make a couple of phone calls and implement an equities rally into new highs in 2016, then we become the 'fools' who believe and buy into it!

Interventions by Central Banks cannot change the long-term trend from 'bearish' to 'bullish'. They are merely delaying the inevitable and just creating a 'slow roasting bear market' (as I have previously mentioned for several months is starting to unfold in the US large cap stocks). While these actions of the Central Bankers are now behind us, we are currently entering the earning season, which is most likely to disappoint Wall Street analysts.

The US is currently experiencing the worst financial and economic recovery during the history of the country's worst financial crisis' and 'recession' since the 1930s Great Depression. Most people don't realize what is happening -- and thus don't see or feel much of this recession. Nonetheless, it's there building momentum in the background. Rest assured it will be a rude awakening for most once the breaking point is reached.

Concluding Thoughts

The US stock market is at the topping point. Odds favor a major market downturn – and subsequently, experience a corrective bounce…but then will continue again to fall even lower.

This will be a big surprise to most…but my followers and I have been watching this unfold for months…and are closely watching the market to time the next BIG SHORT to make our killing.