The Good, The Bad And The Opportunity

The press is demanding the attention of investors more than ever. Whether it was the recent jobs report or last week’s testimony from Janet Yellen, sorting through the market noise is no easy task. Since the world is so interconnected from Facebook to WhatsApp, a spark of news can ignite unfounded fear in an instant. What’s truly significant when it comes to your investments?

The press is demanding the attention of investors more than ever. Whether it was the recent jobs report or last week’s testimony from Janet Yellen, sorting through the market noise is no easy task. Since the world is so interconnected from Facebook to WhatsApp, a spark of news can ignite unfounded fear in an instant. What’s truly significant when it comes to your investments?

Twice a day, in the morning and at lunch, our investment team sits down together to discuss what’s important and what’s immaterial. Last week, in my opinion, the good outweighed the bad. Much of the economic news was a direct result of government policies, both fiscal and monetary. Here are my findings, which I hope will help you filter through the noise.

What are the challenges?

1) As you probably know by now, the Global Purchasing Managers’ Index (PMI) is one of the key metrics we pay attention to as a gauge of the global economy’s strength. In April the Global PMI fell from 52.1 to 52.0, and though the drop was small, investors who previously were encouraged by a synchronized growth cycle, lost some confidence. Japan’s services and manufacturing PMI readings dropped precipitously. The services PMI plunged to 46.4 in April and the manufacturing PMI fell to 49.4. Both numbers were above the 50 mark in the previous month.

The reason for Japan’s slump lies in the consumption tax rate hike, from 5 percent to 8 percent, imposed on the country on April 1. The tax increase was aimed at decreasing the country’s huge public debt, nearly 245 percent of GDP. Just when Japan was finding its economic foothold for recovery, the restrictive fiscal policy caused economic activity to stumble.

Why it matters: The reason for the fall in Global PMI is directly related to Japan’s fall in PMI. Japan has become a drag on global growth. It’s important to recognize the root cause – increased taxes just as monetary stimulus measures were seeing results. This is not good for economic growth and should serve as a cautionary tale for other countries.

2) Another challenging area of the market is China. China’s manufacturing PMI came in lower at 48.1 in April, contracting for the fourth month in a row, and the country also saw a decline of 0.3 percent in its consumer price index (CPI). Employment in the Asian nation is also at a seven-month low, adding growth concerns for the country.

Why it matters: This negative data means there is potential for fiscal policy easing, allowing the Chinese government to boost the economy in the coming months.

Focus on the strong points.

1) The rate of change of global industrial production (IP) was slowing until the close of 2013. Now, however, the global growth outlook is improving. You can see that an inflection point was hit in mid-2013, reaccelerating IP and coinciding with the global GDP outlook for 2014.

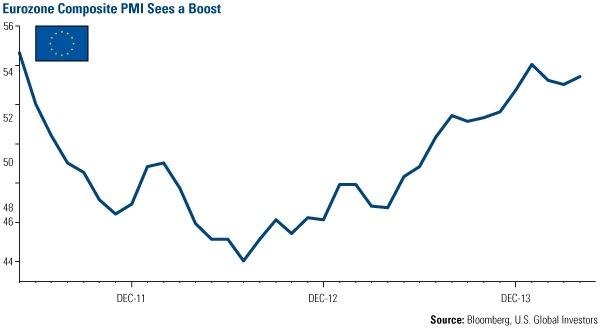

Europe is also doing well. The eurozone composite PMI, a good indication of growth, rose to 54.0 in April. In addition, Spain and the U.K. saw increases in GDP in the first quarter and Spanish banks are seeing a decline in bad debts.

Why it matters: When global IP moves up, this is a sign that momentum in the global economy has changed – for the better. This is good for commodities such as oil, gas and copper, but also for cyclical areas like energy and industrials. There is no doubt that people in every country want upward mobility for their families, and as the demand for better education, cars, etc. continues, commodities and cyclicals should benefit.

2) In a recent report, ISI also highlights that minimum wages are going up in the U.S., citing examples of multi-year wage increases for those who had not received pay increases for the last several years. Various groups who received no increase before will now see a 4 percent rise per year, a leading indicator of wage growth trends. Consumer net worth is also expected to rise by $7.1 trillion in the second quarter, taking it to $82.5 trillion.

Why it matters: Real incomes are expected to rise as wage increases outpace inflation. With the uptick in consumer net worth and steady job growth, consumers will feel more comfortable spending.

Why it matters: Real incomes are expected to rise as wage increases outpace inflation. With the uptick in consumer net worth and steady job growth, consumers will feel more comfortable spending.

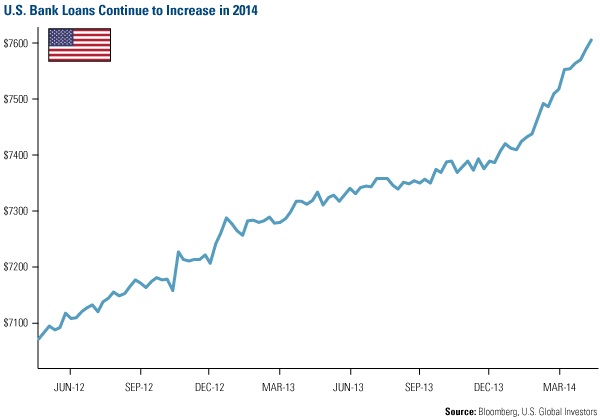

3) Bank loans have seen an increase of 10.4 percent annualized rate over the last 14 weeks. As you can see in the chart below, the number of loans continues to increase. According to the Wall Street Journal, one area where bank lending has accelerated is to commercial businesses.

Why it matters: This positive trend is a potential inflection point for the economy because it indicates economic acceleration. Not only are banks making it easier to borrow by relaxing lending standards, companies are confident enough about the economy to want more money to grow and invest. The WSJ goes on to say that earnings in April from the six largest banks in the U.S. pointed to an increase in commercial loans of 8.3 percent in the first quarter from last year.

Economic data around the globe continues to remain supportive. Even among challenges, there are opportunities to be found. For example, on Thursday we heard that the European Central Bank is likely to ease interest rates in June. This could be another catalyst for Europe, which is already showing improving economic activity.

Similarly, China’s inflation is at an 18-month low as of Thursday, which could increase the odds of a policy response, a positive stimulus for the economy. Japan is dealing with the same thing; the country committed to Abenomics and will likely respond with additional policy support to get back on the recovery track. Don’t let negative news overshadow good news and keep in mind that bad news tells you where the opportunities are.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more of U.S. Global Investors Funds as of 03/31/2014: Facebook.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the links above, you may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. The J.P. Morgan Global Purchasing Manager’s Index is an indicator of the economic health of the global manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at