Here Are Two Ways Investors Can Take Advantage of the Fed’s Uncertainty

Federal Reserve Chair Janet Yellen last week blinked in the face of—as she described it—global uncertainty, low inflation, and a still-low U.S. labor force participation rate. I’ve written on the emerging markets slowdown numerous times in recent months, so her reasoning is not at all surprising.

Federal Reserve Chair Janet Yellen last week blinked in the face of—as she described it—global uncertainty, low inflation, and a still-low U.S. labor force participation rate. I’ve written on the emerging markets slowdown numerous times in recent months, so her reasoning is not at all surprising.

Although interest rates could still be hiked in one of the two remaining times the Federal Open Market Committee (FOMC) meets this year, I’m inclined to think they’ll stay near zero until at least 2016.

The decision is a welcome one for both gold demand and new home purchases. When rates rise, gold becomes less attractive for some investors, who are encouraged to exchange their no-yielding gold for income-producing assets.

As for loans on new or existing homes, they don’t necessarily rise and fall in perfect correlation with interest rates—they’re more directly related to the 10-year Treasury bond yield—but there’s a strong psychological connection in many potential homebuyers’ minds.

An interest rate reprieve, then, might encourage borrowers to act before it’s “too late,” helping home sales. This could speed up the multiplier effect, or what occurs when there’s an increase in spending that increases income and consumption greater than the initial amount spent. When people buy a home, they also put carpenters to work, purchase new furniture, hire landscaping companies and more.

The same is true when taxes are lower. It creates less friction in the flow of money.

A Record-Setting Year for Chinese and Indian Gold Demand?

Following Yellen’s announcement, I told JT Long of the Gold Report that the Fed’s decision is a wash for precious metals, oil and gas prices. A rate hike would have likely caused the U.S. dollar to strengthen even further, which in turn would have put additional pressure on commodities.

I’ll be watching China’s purchasing managers’ index (PMI) numbers very closely in October and November to see if manufacturing activity will start to turn up. Since China is such an important consumer of metals and other raw materials, it’s crucial that its manufacturing sector break out of the recent slowdown.

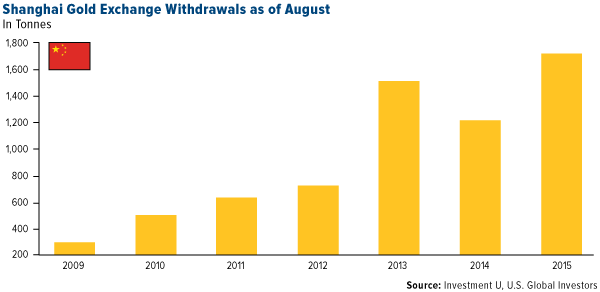

A recent article by Oxford Club Resource Strategist Sean Brodrick points out that China’s gold demand, as tracked by deliveries out of the Shanghai Gold Exchange (SGE), is much healthier than many people believe. So far this year, demand has been 36 percent higher than around the same time in 2014, and 13.5 percent higher than in 2013—which was a record year.

Chinese gold demand also tends to increase near the end of the year as the Chinese New Year approaches, so it’s possible 2015 could hit a new record.

Demand out of India is likewise surging, reaching 120 tonnes in August, compared to 50 tonnes this time last year. With important Indian fall festivals quickly approaching such as Diwali, the gold Love Trade is in full swing.

Homebuilders Feeling Good About the Future

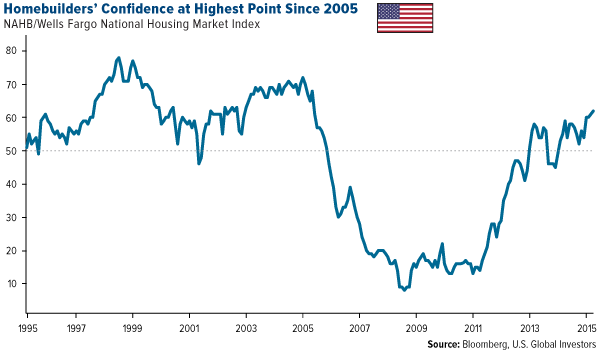

Speaking of love, U.S. homebuilders generally seem to have a rosy feeling about the housing market. According to a new survey by the National Association of Home Builders (NAHB), builder confidence in the market for new single-family homes rose to 62 in September, its highest level since November 2005. A reading over 50 means that builders have a positive attitude about economic conditions.

Driving this sentiment are historically low interest rates, low unemployment and steadily rising rents, which makes purchasing a home more appealing.

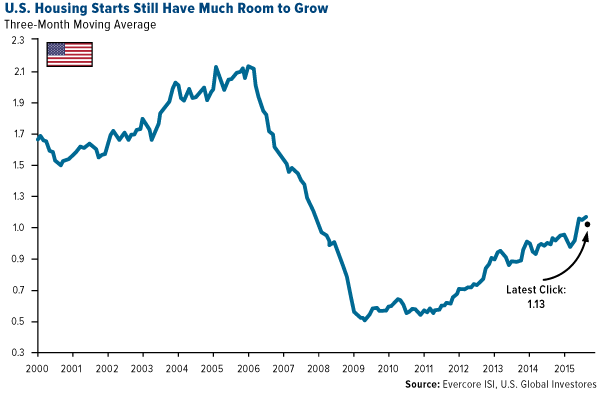

Housing starts in August fell for a second straight month, but they remain above the one million-unit mark—1.13 million, to be exact—so demand is still on solid footing. This week, Evercore ISI wrote:

Housing starts have already more than doubled and are clearly improving here in 2015. But they still have lots of room to increase.

What this means is there’s a lot of upside opportunity.

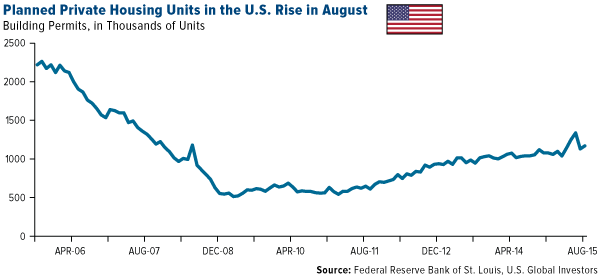

A better indicator of the market might be the number of permits filed for new homes, which ticked up 3.5 percent in August.

We own Masco Corporation, which manufactures products for home improvement and new home construction markets. It’s up more than 23 percent year-to-date, while the S&P Homebuilders Select Industry Index is up nearly 30 percent during the same period.

Big Data: October Is the Best Time to Close on a New Home

The reason for a rise in permits is likely because the fall and winter months have traditionally been perceived as the best time of year to buy a new home, due to less competition from other buyers because of the colder weather.

Real estate information company RealtyTrac wanted to check the validity of this longstanding theory and found it be to mostly accurate. After analyzing 32 million home and condo sales since 2000, the group found that buyers tend to get the best deals during October—just next month—when sales prices were 2.6 percent below market value. And if you want to get really precise, October 8 was the absolute best day to close on a home, “when on average buyers have purchased 10.8 percent below estimated market value at the time of the sale,” according to RealtyTrac.

The worst month to buy a home in was April, when prices were at a 1.2 percent premium.

So the takeaway here is that homebuyers who have been sitting on the fence now have a double-incentive to act: historically low mortgage rates and a possible chance at killer bargains.

Government Policy Is a Precursor to Change

Last week, I discussed how homebuilding is important to money velocity, or the rate at which money is exchanged from one transaction to another. The multiplier effect of the housing market, according to the National Association of Realtors (NAR), is between 1.34 and 1.62 in the first year or two of the initial home purchase. What this means is that for every dollar spent on housing, the overall GDP increases by $1.34 and $1.62.

That’s huge. Not just for GDP growth but also job growth.

Global Construction magazine estimates that an average of 22 subcontractors are involved in the building of a single American home, from carpeting specialists to electricians to plumbers. These are just the subcontractors. The count doesn’t include full-time employees of the homebuilder.

All told, then, many more than 22 people are employed in the construction of each home in the U.S., on average. These professionals create wealth not just for themselves but for others as well.

According to Reuters, construction spending by the U.S. government increased 0.7 percent to a huge $1.08 trillion, the highest level since May 2008. Construction spending has increased for eight straight months, in fact.

This is why we always study government policies, because they’re precursors to change.

It’s why government bond yields spiked in anticipation of the Fed decision. The spike lowered the prices of bonds substantially. Based on our models, the drop in bond prices gave our portfolio managers a buy signal in our Near-Term Tax Free Fund (NEARX), allowing us to pick up some nice bargains in short-term municipal bonds attractive at that level.

While Americans are in the early stages of the presidential election cycle, and the debate stage is still crowded, Canadians will head to the polls in a month to decide the direction of their federal leadership.

I’ve been in Toronto this week where the mood is tense as the effect of falling commodity prices has hit the resource-based Canadian economy especially hard and the Canadian dollar is at its lowest level against the almighty American dollar since 2004.

If the Conservative Party remains in power, Prime Minister Stephen Harper will be the first person in more than a century to win four consecutive elections in Canada. It’s also the first three-way toss up in the nation’s history of Parliamentary elections.

Harper has been a reliable champion of commodity investments, small government and lower taxes—policies that I believe contribute to global growth and prosperity over the long term.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P Homebuilders Select Industry Index is a modified equal weight index that represents the homebuilding sub-industry portion of the S&P Total Markets Index.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Near-Term Tax Free Fund as a percentage of net assets as of 6/30/2015: Masco Corporation 0.00%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at