Investors Weekly Update

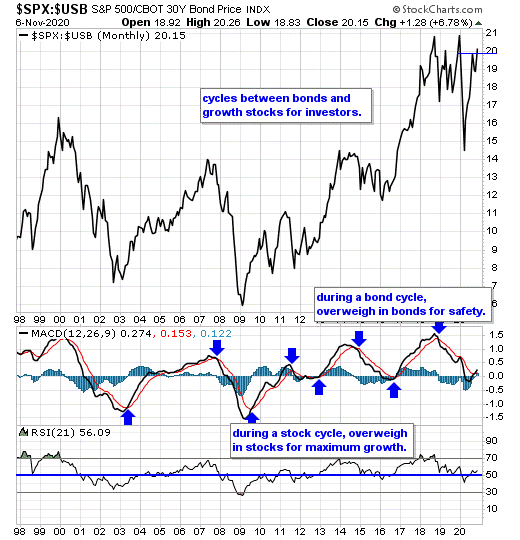

Our equity/bond model - This long-term reliable investing model provides investors with simple decision making in the markets:

- When the model favors stocks, investors should overweigh in equities for maximum growth.

- When the model favors bonds, investors should overweigh in bonds for safety.

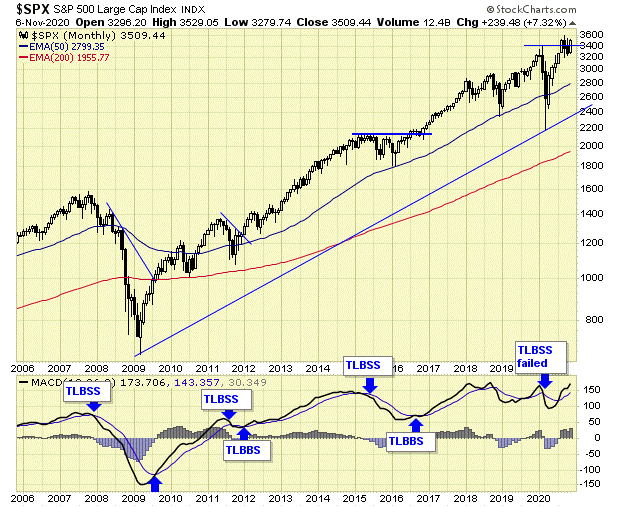

Our benchmark S&P500 is back on long-term BUY signal as of end of October.

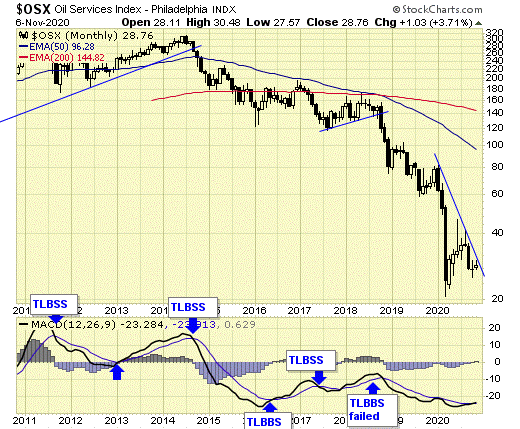

Oil sector remains on long-term SELL signal as of end of October.

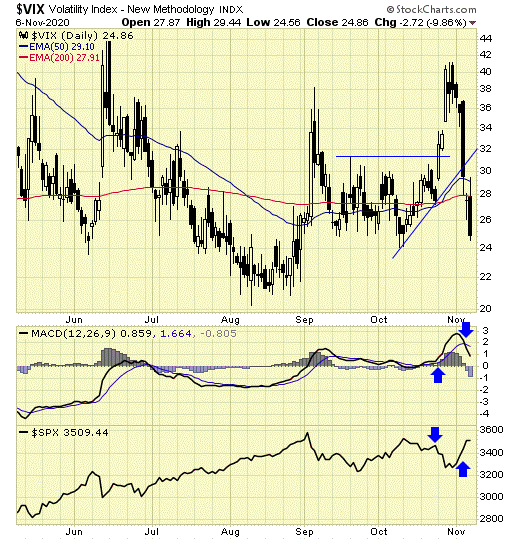

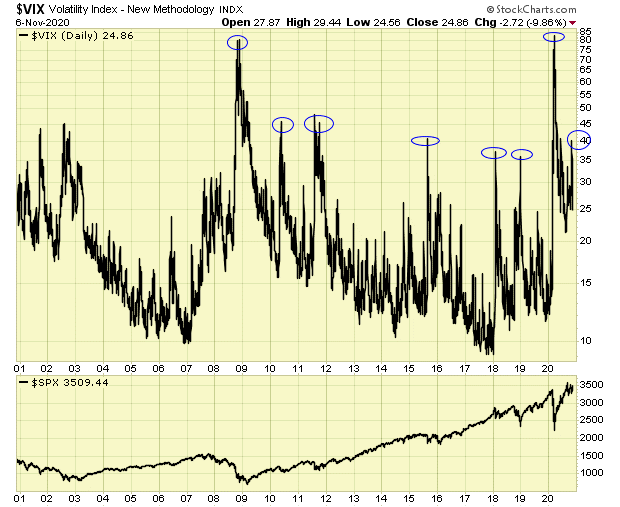

VIX – volatility index

VIX is down and markets are up.

VIX spiked up to over 40 last week, and since the bull market which began in 2009, these VIX spikes have proven to be good entry points.

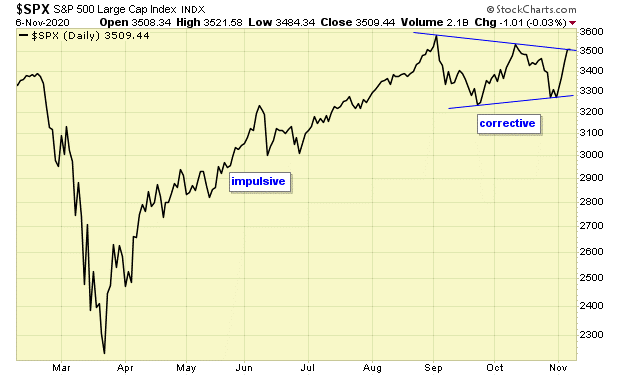

$SPX is consolidating after the huge run up from March.

So far we see a 3 wave pattern, but as we can learn from the gold sector, it’s likely that we will see a 5 wave pattern after the impulsive phase off the panic bottom in March.

Summary

Our benchmark S&P500 is on a long-term BUY signal.

However, the current investing model remains in favor of bonds, therefore, investors should continue to overweigh with long bonds or bond ETFs for safety over growth.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple investing model which provides us with simple investing decision making. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets.

********