Investors Weekly Update

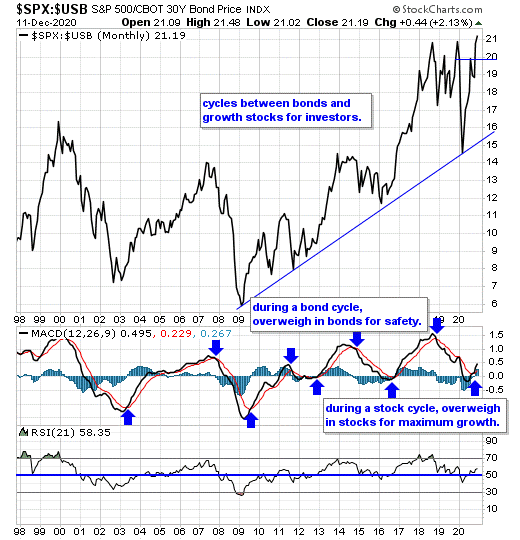

Our equity/bond model - This long-term reliable investing model provides investors with simple decision making in the markets:

- When the model favors stocks, investors should overweigh in equities for maximum growth.

- When the model favors bonds, investors should overweigh in bonds for safety.

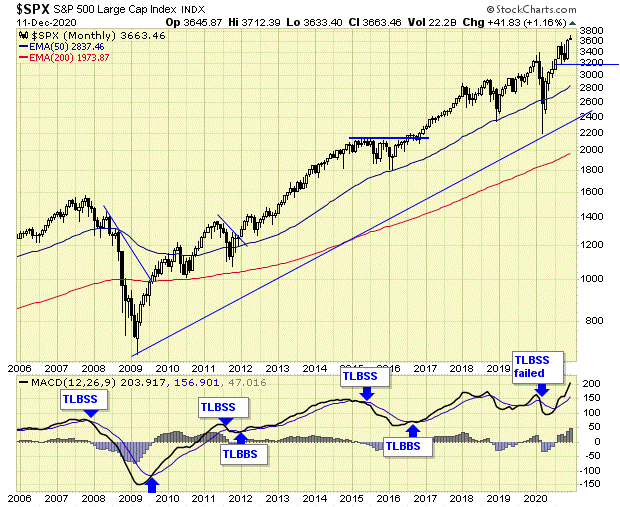

Our benchmark S&P500 is back on long term BUY signal as of end of November.

Oil sector is on a new long-term BUY signal as of end of November.

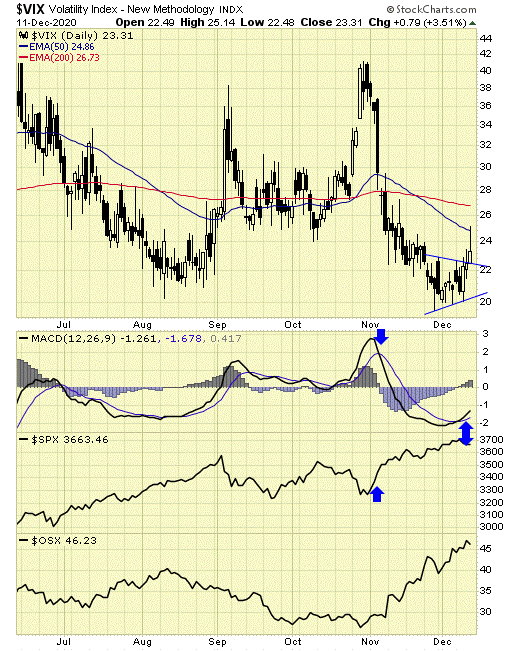

VIX – volatility index

VIX is now up, caution is advised.

Summary

Our long-term stocks/bond model is now in favor of stocks over bonds.

Investors should overweigh their portfolios with stock/stock ETFs for maximum growth.

The energy /oil sector has a new long-term buy signal and should produce above average return over the next few years.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple investing model which provides us with simple investing decision making. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets.

********