Silver And Bank Stock Lovebirds

Gold functions like an alarm clock. A rising gold price usually indicates that financial uncertainty and volatility are the dominant market themes.

Inflation that begins to get out of control can cause the price of gold to rise almost vertically, but during the transition period from deflation to inflation, bank stocks and financial companies tend to be the best leading indicators.

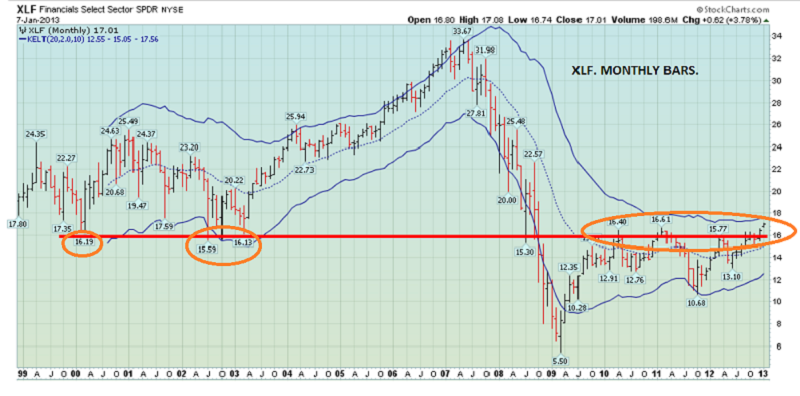

You are looking at the monthly chart of the XLF financial sector ETF. The $16 area is one of strong resistance.

A correction is to be expected, but there are signs that the financial sector is on the verge of a substantial trending move to the upside.

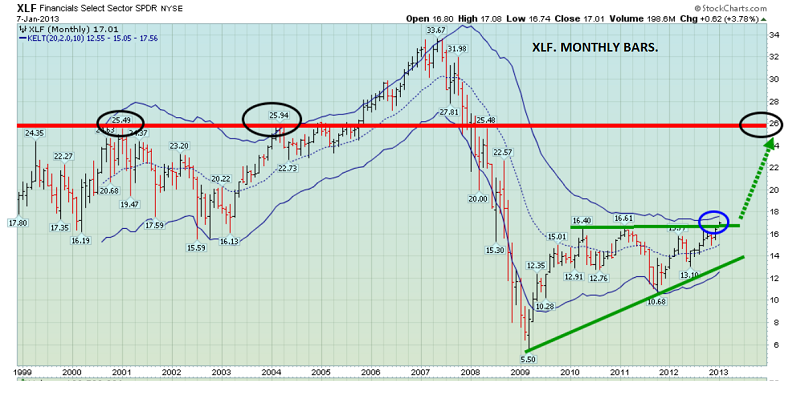

I've highlighted a large bullish ascending triangle in green. Note the blue circle around the current price. XLF appears to be trying to stage a breakout.

The target of the triangle pattern is roughly the previous highs in the $26 area.

If financial stocks begin to surge higher, it would likely signal an end to deflation, and a beginning of inflation. That would be very good news for your gold and gold stocks.

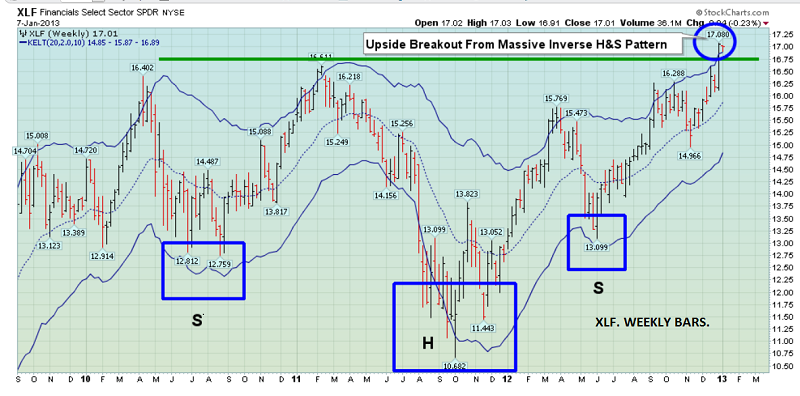

I'd like you to take a closer look at the current price action of financial stocks. You are now looking at the XLF weekly chart, and I've highlighted an upside breakout from what appears to be a truly monstrous inverse head and shoulders pattern.

That breakout suggests that a "reflation of the world" theme is probably now set to replace the deflationary mindset held by most investors.

In regards to gold: "People seem to be universally bullish, but the price isn't moving…" - Reuters News, Jan 8, 2013, quoting Ross Norman, the top-ranked LBMA gold forecaster.

Ross has a good track record, but I have some concerns about his view that most people are currently bullish about gold.

He's obviously correct that the gold price is stuck in a quagmire, but rather than "universally bullish", I see most investors as bearish and demoralized.

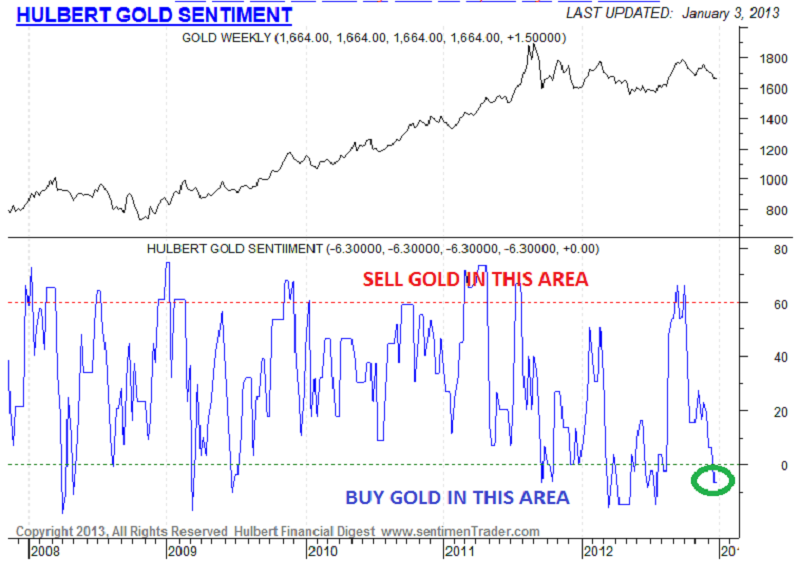

That's the latest Hulbert "Gold Sentiment Chart". He surveys a large group of gold timing services.

I see overwhelming bearishness on that chart. Hulbert uses his survey as a contrary opinion indicator, and it has a superb track record of calling intermediate term movements in the gold market.

Silver is the metal most likely to benefit from a "reflation of the world" theme. Platinum and palladium should also do well.

If you have 100 units of risk capital to allocate to the metals market, I think 70 units for gold and 30 for silver is a good way to handle real risk and potential reward.

Reflation can lead to hyperinflation, and gold is the metal you want to hold the most of, in such an environment.

Central banks tend to take very drastic action when inflation starts to go out of control, and that can hurt metals like silver, platinum, and palladium.

Regardless, it's silly to worry about the popping of an inflationary bubble when it is just beginning to get inflated!

At this point in time, silver is my "metal of choice" for fresh buys. That's the daily chart for silver.

After bursting above the black downtrend line, the breakout was confirmed by a 14,7,7 Stochastics series crossover buy signal.

It's normal to take several weeks, or even longer, for intermediate trends to really get going, after such buy signals appear on a chart.

Amateur investors have a tendency to want to rush things a bit, and then throw in the towel just as the real move gets underway.

Silver looks superb at this point in time, and the budding breakout in financial stocks may be the surprise catalyst that makes every silver investor's upside dream come true!

Special Offer For Gold-Eagle Readers: Send me an email to freereports4@gracelandupdates.com and I'll send you my free "Golden Head Fakes" report. Learn how to place profitable short term trades in the metals markets, by selling technical breakouts, and buying breakdowns!

Stewart Thomson

Graceland Updates

www.gracelandupdates.com

Email: stewart@gracelandupdates.com

Mail to:

Stewart Thomson

1276 Lakeview Drive

Oakville, Ontario L6H 2M8 Canada

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: