Silver Bells Ring: Are Investors In Tune?

Will the precious metals stage another rally in the Chinese New Year “traditional buying season” of January-February?

The charts suggest that is very likely. The daily gold chart.

A potential inverse H&S pattern is in play, with a target price of at least $1966… and arguably as high as $2024!

The right shoulder of the pattern may be under construction right now. That suggests a January breakout to the upside is imminent.

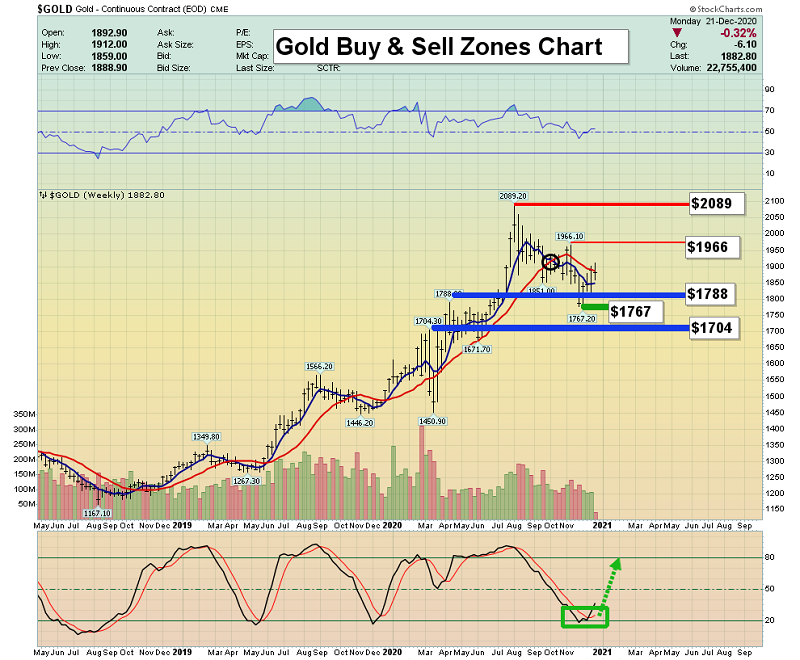

The important weekly chart.

I’ve urged investors to take note of the 14,5,5 full Stochastics series oscillator whenever gold (or any major asset) arrives at a key support zone.

A buy signal is now in play for that oscillator and it is occurring after gold has traded at my key $1788 support price.

The 5,15 moving average series has flattened out. There’s no buy signal yet, but it is a confirming indicator.

The US dollar continues to ooze lower against the safe-haven yen.

It’s debatable whether the yen is really a safe haven, but the big bank FOREX traders view it as such, and their liquidity flows are most important to price discovery.

The pathetic action of the dollar against the yen is likely indicating that there is significant fundamental strength in the gold market.

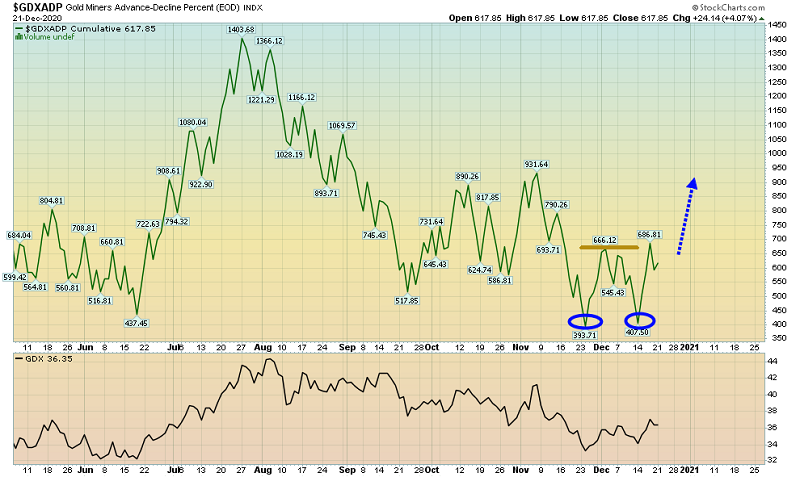

What about gold stocks? The GDX advance/decline chart. Here is some important technical action. The bottom line is this: I see green shoots!

Although most mining stocks aren’t as strong as gold or silver right now, this “lagging action” often happens at the start of intermediate trend rallies.

A rally to about $1920 for gold should see the miners begin to outperform bullion again.

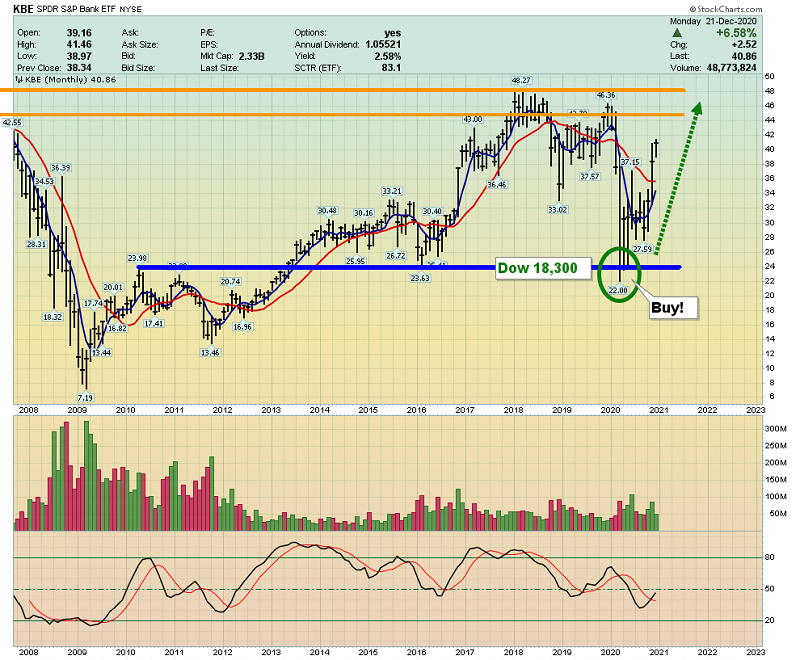

The bank stocks ETF chart.

While millions of Americans grovel in unemployment lines for a $600 government handout, the banks have another green light to buy their own stocks with impunity.

Most gold bugs don’t like the banks, and rightly so, but this could be a case of, “If you can’t beat them, join them.”

For investors who didn’t buy bank stocks at my key Dow 18,300 mark, I would suggest waiting until the first couple of weeks in January before placing new money into this market.

The KBE bank stocks ETF needs to trade above $50 for at least a month of time before another important buy signal is generated.

If inflation appears, bank stocks could do well, but silver bullion and silver miners are the most important sector to own in an inflationary environment!

PLACE ST6 CHART HERE

The interesting silver chart.

After forming a rough double bottom pattern, silver has rallied to the $26-$26.50 resistance zone.

A pause now is expected and normal; the Christmas & New Year holidays are upon us, but any resistance zone deserves to be respected even when there is no holiday in play. Regardless, silver is likely to outshine gold in 2021.

Please click here now. Are silver investors ready to ring in the new year with higher priced cheer? I think so. Happy Holidays!

Special Offer For Gold-Eagle Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Junior Hot Shots!” report. I highlight juniors that are surging higher while most miners lack “mojo”. I include solid buy and sell tactics for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: