Truly Epic Silver Signals: Vying For Your Attention

If we had to pick one day, or one situation when a single market provided most indications during a single day, it would be yesterday’s performance of silver.

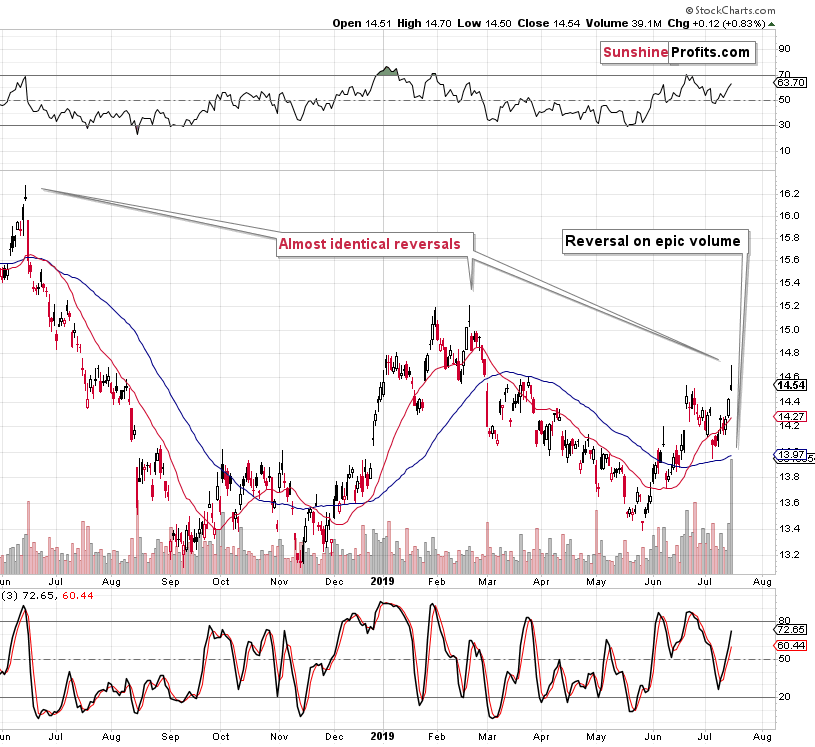

There’s not much to say about yesterday’s session while looking at gold and mining stocks – they both moved a bit lower. But things are very much different when we look at silver. The white metal jumped higher decisively, rallying above the June highs and the SLV ETF soared on volume that we haven’t seen so far this year. The volume was even higher than what we saw at the 2016 top! It was bigger than what we saw at the late-2012 top (that one was close, though)! In fact, the only year when we saw higher daily volume during silver’s upswing was 2011. Except for THE silver top, the mid-2012 rebound, and the late-2010 massive run-up, all other cases when silver soared, were accompanied by volume what was lower than what we saw yesterday. And these were almost always major tops. Combining this with the shape of yesterday’s candlestick in the SLV gives us very clear indications. They are beyond-words bearish.

Let’s take a look at the chart for details.

Silver’s Volume Record

SLV may be viewed as paper silver by some (just as GLD may be viewed as a form of paper gold), but it can be very useful for detecting market turnarounds, because of its relative popularity among individual silver investors.

Looking at the past year, it’s obvious that the shape of yesterday’s candlestick is just like what we saw at the 2019 high and at the mid-2018 top. The price of silver opened the day higher, then rallied only to give away the intraday gains before the session was over. This all happened while gold and mining stocks declined a bit, so it was a crystal-clear case of silver’s outperformance.

Reversals, such as shooting stars in silver, should be confirmed by big volume as the session should represent how bears overwhelmed bulls in a fierce battle. In this way, the session shows that bulls gave their best but still lost to bears. From that point, lower prices are to be expected as bears have proven to be stronger, and because when nothing happens in the market (there are no buyers and no sellers), the price simply falls. The important part of all this is volume, because its absence means no fierce battle. This means no profound victory of bears – just a back-and-forth action without much meaning.

To say that yesterday’s volume was big would be like saying that continuously smashing one’s face against the wall is not the best use of their time. It’s true, but it doesn’t cover the full story either. The silver volume was huge. It was breathtaking, and it was epic. The above chart is not big enough to show to huge it really was, because there is nothing else that’s similarly big.

Silver’s Volume Record: Full Perspective

We enlarged the volume readings and we added a horizontal red line, to make it clear when volume was bigger than it was yesterday – we haven’t seen it as high as we did yesterday since late 2011. Of course, we mean only the days when silver moved higher.

We marked other cases when volume was somewhat similarly high or when it was big on relative basis (yesterday it was huge in both: absolute and relative terms). In the vast majority of cases, these were excellent opportunities to short silver. Yes, it’s counter-intuitive (silver rallied on big volume so it’s showing strength, right?) and counters the technical-analysis-basis, but it’s highly effective. And please remember that we are talking about the volume alone here.

The shape of yesterday’s session was very bearish on its own, and so is the fact that the price of silver clearly outperformed the price of gold. The combination of all three factors (volume, reversal, out-performance) is what makes yesterday’s session the clearest bearish silver sign that we saw in many months.

You may think that we’re crazy, you may think that we’re perma-bears (which is not true), or that we hate silver (actually, that’s our preferred metal of choice for the long run, but there are some cases when it’s better to be invested in something else), but that’s not true. If there was just one trade to be made based on our analysis this year, we would suggest it being the short position in the precious metals market right now. The silver signals are one of the most effective precious metals trading tips and we just saw a three-strong combination of epic proportions that happened right after we had already seen multiple non-silver signs pointing to the decline in the precious metals market in the upcoming months.

Today's article is a small sample of what our subscribers enjoy on a daily basis. For instance today, we have also shared the lessons from the joint gold and USD Index examination with them. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. On top, you’ll also get 7 days of instant email notifications the moment a new Signal is posted, bringing our Day Trading Signals at your fingertips. Sign up for the free newsletter today!

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********