UBS Sees Platinum Prices Rising To $1,150 Per Ounce By Year-End

Strengths

- The best performing precious metal for the week was silver, up 2.66% on positive physical demand noted traders. Gold is heading for its best weekly performance since mid-November amid a rout in the dollar as money managers pared back bullish bets. The dollar is on course for its worst week since May after dropping in the aftermath of the highest U.S. consumer inflation print in 40 years. On Friday, the currency extended its decline, providing further support to gold even as real yields ticked higher. “The positioning pain trade for long U.S. dollar has been a key contributor to gold’s ability to outperform versus rates,” said Marcus Garvey, head of metals strategy at Macquarie Group Ltd.

- K92 Mining Inc. said that its Kainantu Gold Mine in Papua New Guinea experienced record production levels in the fourth quarter. On gold, copper, and silver: "K92 Mining Inc. announces production results for the fourth quarter of 2021 at its Kainantu Gold Mine in Papua New Guinea, of 36,145 ounces silver and 33,220 ounces gold.”

- Yamana Gold reported fourth quarter production results above expectations. Fourth quarter production of 281,000 ounces was exceeded consensus of 274,000 ounces. This should lead to strong free cash flow in the fourth quarter. Yamana ended 2021 slightly beating guidance with 1.01 million ounces produced.

Weaknesses

- The worst performing precious metal for the week was palladium, down 2.77%, likely on talk more substitution from platinum. Mali’s President Assimi Goita opened for dialog with the West African regional bloc after Mali shut its borders with member states in response to sanctions on the gold- producing country for refusing to hold elections next month. Mali remains open to talks with the Economic Community of West African States to try and reach a consensus, Goita said in a statement on the state broadcaster Monday.

- IAMGOLD said President and Chief Executive Officer Gordon Stothart has stepped down from his role and resigned from the board of directors. The company’s CFO and Executive Vice President Strategy and Corporate Development Daniella Dimitrov has been appointed president and interim CEO effective immediately. IAMGOLD’s 2022 midpoint production guidance of 605,000 ounces is 7% below the 651,000-ounce consensus. 2022 cash cost guidance is $1,125/ounce versus $1,196/ounce consensus. At Essakane, the company expects to produce 360-385,000 ounces in 2022 and 325-375,000 ounces in 2023/24. Rosebel is expected to produce 155-180,000 ounces in 2022 and 180-200,000 ounces in 2023/24.

- Indian gold demand is taking a hit as the second biggest buyer of is scaling down the size of traditional weddings as the Omicron virus is rapidly spreading. They have gone to over 200,000 cases per day from 10,000 cases a month ago. Indian demand has been really subdued over the past 2-years with virus mobility issues but is likely to rebound with the expectation this wave will pass fast.

Opportunities

- UBS sees platinum prices rising to $1,150 per ounce by the end of the year as the global chip shortage leads to a significant restocking of cars, strategists for the bank, including Wayne Gordon, wrote in a note. They expect palladium to rebound to $2,000/ounce as the market returns to balance.

- i-80 Gold announced that its CEO Ewan Downie had raised his ownership to over 5 million shares or just over 2% of the company through open market purchases of 1.4 million shares. i-80 completed a series of transactions in 2021 has the Lone Tree complex in Nevada and which includes adding the Lone Tree project with gives i-80 Gold the ability to even process refractory ores.

- Royal Gold reported fourth quarter stream sales of 62,000 ounces, versus a 61,000-ounce consensus. This was attributable to higher silver sales, where production is contributed by the company’s Pueblo Viejo stream and its Khoemacau ramp-up stream. The reported stream segment results position the company to deliver total corporate GEO production at or slightly above the top end of its guidance range for 180-190,000 ounces in the second half. Royal Gold had approximately 26,000 ounces in inventory at end of 2021.

Threats

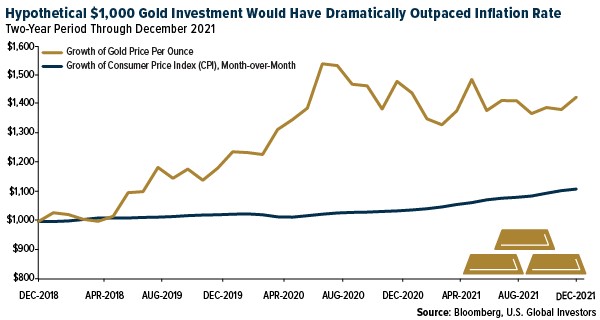

- With inflation running the hottest since 1982 in the U.S. some less experienced investors are asking why didn’t the price of gold go up? The metal has been stuck around $1,800 an ounce for months traders’ lament. However, as the chart above shows, the market doesn’t serve up free lunches. In 2018, gold was up 18% and another 25% in 2020 as the metal anticipated future inflation. Over the three-year period, just to keep up with inflation, you needed an asset to increase to $1,111, from a $1,000 base. An equivalent investment in gold over that period grew to $1,426, far out matching inflation and perhaps delivering the price pause in 2021. This suggests that if you expect future inflation, you may consider adding gold exposure to your portfolio.

- Mali’s military ruler signals he is open for more talks with West Africa’s economic bloc about returning the nation to civilian rule and asked the group to reconsider sanctions imposed over his refusal to hold elections next month. Mali is Africa’s third-biggest gold producer and companies, including Barrick Gold. B2Gold also has operations in the country. Miners in Mali should prepare for “significant disruptions to their export routes and logistical supply lines” as long as Ecowas maintains its ban on trade and financial exchanges with the country, Verisk-Maplecroft analyst Alexandre Raymakers said in a note. “Considering the importance of the gold mining sector as a source of revenue for Bamako, we do not expect the bloc to provide any exemptions to miners.”

- Barrick Gold, the world’s second-biggest gold miner is confident prices will hold firm this year, if not rise, as investors use the metal rather than cryptocurrencies to hedge against inflation and jewelry demand picks up. “The risk is on the upside,” Barrick Gold Corp. Chief Executive Officer Mark Bristow said in an interview in Riyadh, Saudi Arabia. “I don’t think there’s very much risk on the downside.” Bullion faces growing competition from Bitcoin and other cryptocurrencies that are increasingly pitched to investors as a modern-day gold and an effective hedge against inflation. Goldman Sachs Group Inc. argued that Bitcoin is taking market share from gold as a store-of-value investment. “Look at gold and its precious nature -- you can’t print it and you can’t make it,” Bristow said. “You can make cryptocurrencies, and there are many of them. When you’re in a dynamic phase like we’re in now and the world’s uncertain, it’s always good for gold.”

*********

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at