Wall Street Underestimates the Great American Earnings Machine

We’re only halfway through the month, but so far the old trading adage “Sell in May and go away” seems a little premature.

Last Thursday, the S&P 500 Index closed at new consecutive record highs, topping the previous record set on April 24 and further extending the 6-year bull-run. The surge came on the heels of weaker economic data last week, leading investors to believe that the Federal Reserve will refrain from raising interest rates this summer, if not this year.

All 10 sectors ended Thursday’s session in the black, with technology leading the rally. Apple, held in both our All American Equity Fund (GBTFX) and Holmes Macro Trends Fund (MEGAX), and Facebook, held in MEGAX, made the widest gains.

Friday’s close came within just a few points of another new high, suggesting that a top has not yet been reached but that instead the market is looking to break out.

Dividend Growth at 15 Percent

With a little over 90 percent of S&P 500 companies having reported average first-quarter earnings for the index rose a modest 2 percent. That might not seem significant, but as LP Financial’s Chief Investment Officer Burt White points out in a recent Barron’s piece, “given the steep uphill climb that corporate America faced due to the twin drags of the oil downturn and strong U.S. dollar, this is actually a good result.”

Indeed, when the earnings season began, economists were expecting to see a 3-percent drop because of depressed oil and the strong dollar. Of course, we’re now seeing a price reversal in both the commodity and currency.

Dividends from S&P 500 companies also rose, jumping about 15 percent in the first quarter, defying lackluster estimates. Delta Air Lines, also in MEGAX, announced this week that it would be raising its dividend 50 percent as well as buying back $5 billion in stock over the next couple of years.

What’s important for investors to recognize here is that the S&P 500 dividend yield is currently at 1.92 percent, ahead of the 1.50-percent yield on a 5-year government bond. And unlike the government bonds, equities give you potential growth. It’s these high dividend-paying companies that GBTFX and MEGAX seek to invest in.

Investors Shrug Off Weak Economic News

The week’s economic data suggests that the U.S. economy is growing at a slower rate now than in previous months.

The week’s economic data suggests that the U.S. economy is growing at a slower rate now than in previous months.

According to the U.S. Census Bureau, retail and food service sales in April were little changed from March. Inventories are steadily creeping up.

On Friday, economists trimmed their forecast for the rate of jobs growth this year from 3.2 percent to 2.4 percent. Meanwhile, the University of Michigan consumer confidence index fell pretty dramatically from 95.9 in April to 88.6 in May.

This soft economic news appears not to have dampened investors’ spirits too much, however, as it means the Fed will be more likely to keep rates low for at least the short-term.

You can see that the M1 money supply, the most liquid form of capital, began to ramp up with the first round of quantitative easing (QE) in late 2008, pulling the S&P 500 up with it. We called the bottom of the market in an Investor Alert from December 2008.

After three cycles, QE officially wrapped up last October, but money continues to flow into the market, lifting all boats.

Lately, investors have been moving more of their money out of domestic equity funds and into internationally-focused funds, especially those focused on Europe, according to a Credit Suisse report. This is in line with the results of a Bloomberg survey I shared earlier in the month which shows that global investors are most bullish on the eurozone than any other region, a good sign for our Emerging Europe Fund (EUROX).

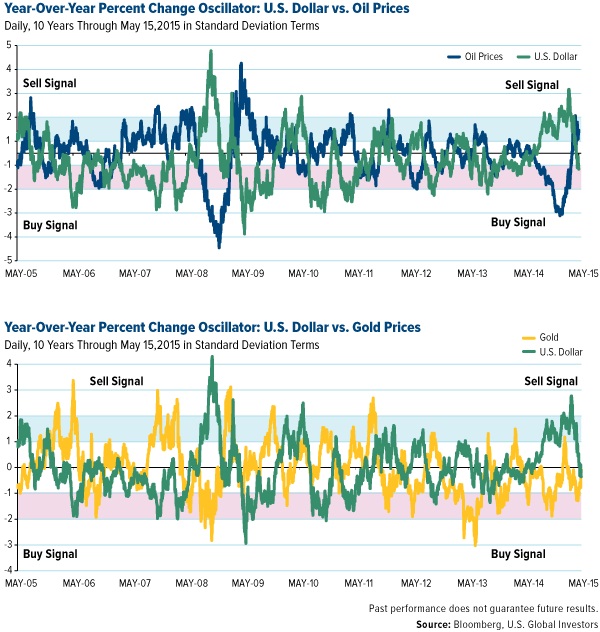

Significant Inverse Relationship Between the U.S. Dollar and Gold/Oil

The U.S. dollar lost more ground for the fifth straight week, falling to its lowest level since January. This has allowed crude oil to begin its recovery—it’s currently trading just below $60 per barrel—while gold marks time in the $1,220 range.

As you can see, the dollar reverted back to its mean after rising to close to three standard deviations as recently as mid-March. There’s plenty of momentum for the dollar to drop even further, which should help oil’s recovery.

Gold remains in a three-year bear market. In an interview with Jim Puplava on the Financial Sense Newshour, I explained that the domestic equity bull market has lately overshadowed the yellow metal as an asset class, but that when gold’s down, as it is now, it might be time to put money in gold and gold stocks.

This week we expect to see preliminary purchasing manager’s index (PMI) numbers for not only the U.S. and Europe but also China. Perhaps we’ll see if the U.S. economy has really softened or if it’s simply taking a breather after months of steady growth.

Happy investing!

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile.

M1 Money Supply includes funds that are readily accessible for spending.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time. Note that stocks and Treasury bonds differ in investment objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, and tax features.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the All American Equity Fund, Holmes Macro Trends Fund and Emerging Europe Fund as a percentage of net assets as of 3/31/2015: Apple Inc. 4.03% in All American Equity Fund, 5.34% in Holmes Macro Trends Fund; Delta Air Lines Inc. 1.93% in Holmes Macro Trends Fund; Facebook Inc. 3.23% in Holmes Macros Trends Fund.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at