Why Mining Companies Could Expect Many Benefits To Be Had

Strengths

•Gold traders were bullish for the fourth-consecutive week. The increased optimism related to gold prices stems from the recent turmoil in global markets as well as the continued dovish stance by the Federal Reserve.

•The Swiss National Bank introduced a negative interest rate on deposits this week. The move, aimed at relieving upward pressure on the franc, should make gold relatively more attractive than franc-denominated assets.

•Gold exports out of Switzerland reached the highest level this year. Furthermore, in order to meet rising demand from Asia, Swiss refineries are working at full capacity.

Weaknesses

•President Barack Obama indefinitely withdrew more than 52,000 square miles of waters off Alaska’s coastline in order to protect the wildlife in the area. However, miners should get some leeway when it comes to the new law if the Republican-backed proposal bans the Endangered Species Act from applying to the sage grouse for one year.

•Barrick Gold Corp. is suspending its Lumwana operations in Zambia following a newly established increase in the mining royalty rate. The rate is set to increase from 6 percent to 20 percent for all open-pit mines.

Opportunities

•With diamond prices on the rise due to short global supply, retailers are looking for opportunities to invest in, or secure supplying deals directly from, individual mines. This would allow them to avoid the intermediate processes all together. Chow Tai Fook, the world’s largest listed jeweler, said it is specifically looking at Canadian projects, providing a great opportunity for many mining companies to make a deal.

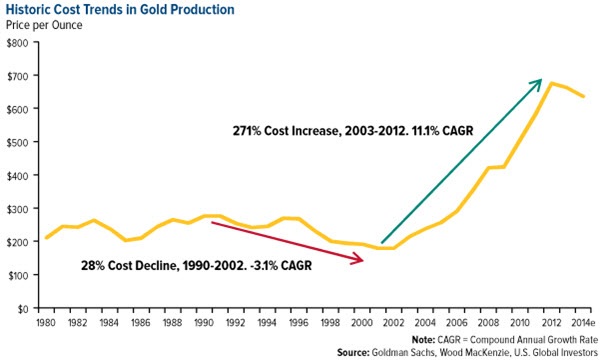

•Moving into 2015, many benefits are expected to be had by mining companies given the current environment. Specifically, declining energy prices and depreciating operating currencies could lead to lower costs and expanding margins. The chart above illustrates that costs seem to be rolling over now. Additionally, more mining companies could close their cash-negative assets, focusing attention on productive assets instead. Consolidation remains an opportunity for the industry as well, especially given the recent correction in gold prices.

•Australia & New Zealand Banking Group Ltd. expects gold prices to recover next year due to increasing demand from China and India. The bank forecasts a gold price of $1,280 by the end of 2015.

Threats

•Contrary to other positive forecasts, Oversea-Chinese Banking Corporation (OCBC) is predicting a continued slide in gold prices down to $1,000. This is because of higher interest rates alongside tamed inflation due to falling oil prices.

•India’s government is taking a wait-and-see approach before making any official policy decisions to stem rapidly growing gold imports. Gold imports have risen six times, substantially weakening the country’s trade account.

•The recent damage done to the Russian economy and the ruble are leading some to speculate that the government will begin selling gold. The desperate move could put downward pressure on bullion prices.

********

Courtesy of http://www.usfunds.com

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at