Gold and silver surge to record highs as rate-cut expectations and geopolitical risks intensify

LONDON (December 22) Precious metals have surged to unprecedented levels, with both gold and silver setting new all-time highs as investors seek protection amid shifting monetary policy expectations and escalating geopolitical uncertainty affecting global markets.

Gold climbed above $4,400.00 per ounce for the first time, extending an already historic rally that has defied even bullish expectations.

The move has been underpinned by growing confidence that the US Federal Reserve (Fed) is going to remain on its easing path in 2026.

Fed policy expectations drive momentum

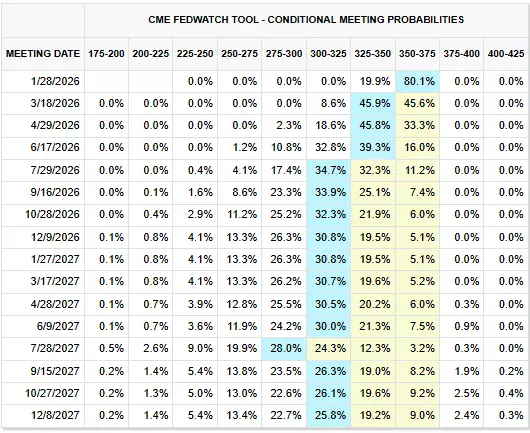

Recent economic data indicate moderating inflation pressures and a cooling labour market, prompting markets to price in two interest rate cuts next year.

2026-to-2027 US Fed rate cut expectations

Source: CME FedWatch Tool

Source: CME FedWatch Tool

Attention is now turning to the upcoming second estimate of third quarter (Q3) US gross domestic product (GDP), which could offer further insight into economic strength and reinforce expectations for a more accommodative Fed stance that would reduce the opportunity cost of holding gold.

Lower interest rates typically benefit gold and silver by reducing the opportunity cost of holding a non-yielding asset compared to bonds.

Geopolitical tensions amplify safe-haven demand

Geopolitical tensions have added another layer of support to precious metals. The United States is reportedly tracking an additional vessel near Venezuela after seizing two tankers earlier this month while Ukraine has carried out its first-ever strike on a Russian tanker in the Mediterranean, escalating regional tensions.

These developments have heightened concerns around global energy security and trade routes, driving renewed demand for safe-haven assets.

Gold prices are now more than 67% higher year-to-date, placing the metal on course for its strongest annual performance since 1979.

Gold weekly candlestick chart

Source: TradingView

Source: TradingView

Institutional demand reinforces rally

Beyond macro and geopolitical factors, the rally has been reinforced by aggressive central bank purchases and sustained inflows into gold-backed exchange-traded funds (ETFs), signalling long-term institutional confidence in bullion as a portfolio diversification tool and reserve asset.

Silver has followed gold's lead - surging more than 37% in the past five straight weeks - to above $69.00 per ounce, also marking a new record high.

Silver weekly candlestick chart

Source: TradingView

Source: TradingView

Like gold, silver is benefitting from expectations that the Fed will loosen policy further next year.

Silver's dual role enhances appeal

Markets are now pricing in two additional Fed rate reductions, a backdrop that tends to favour precious metals broadly.

Heightened geopolitical risks have strengthened silver's appeal as a defensive asset alongside its precious metal cousin.

However, silver's rally is not solely driven by safe-haven flows - the metal continues to enjoy robust industrial demand, particularly from fast-growing sectors such as solar energy, electric vehicles, and data centres that require silver's unique properties.

Industrial demand provides structural support

This dual role as both a monetary and industrial metal provides silver with a unique structural advantage in the current environment.

Looking ahead, silver is on track for a near 135% gain in 2025, reflecting both cyclical tailwinds from monetary policy expectations and strong long-term fundamentals tied to the global energy transition and digital infrastructure buildout.

The industrial demand component distinguishes silver from gold, providing additional fundamental support beyond purely monetary factors.

IG