Deceptive Rally? Measuring Silver’s Relative Strength

It’s tempting to ride the silver rollercoaster. After-all, gold’s volatile little brother is just that – volatile. Its wilder price swings make some of the investment public believe they can profit from it more quickly. However, it’s important to remember and take note of the fact that silver (or gold and miners for that matter) should not be judged on its own when making a purchasing decision. It’s a bit more complicated and other factors come into play, such as relative strength.

One must track the precious metals’ performance against equities or the USD Index. Asking questions is prudent; how is silver doing compared to gold, and why? The USDX is moving lower but the PMs are not rallying? Hmmm, is there enough strength for them to break out? Silver or gold don’t exist in a vacuum. Instead, their performance has to be judged relative to other factors.

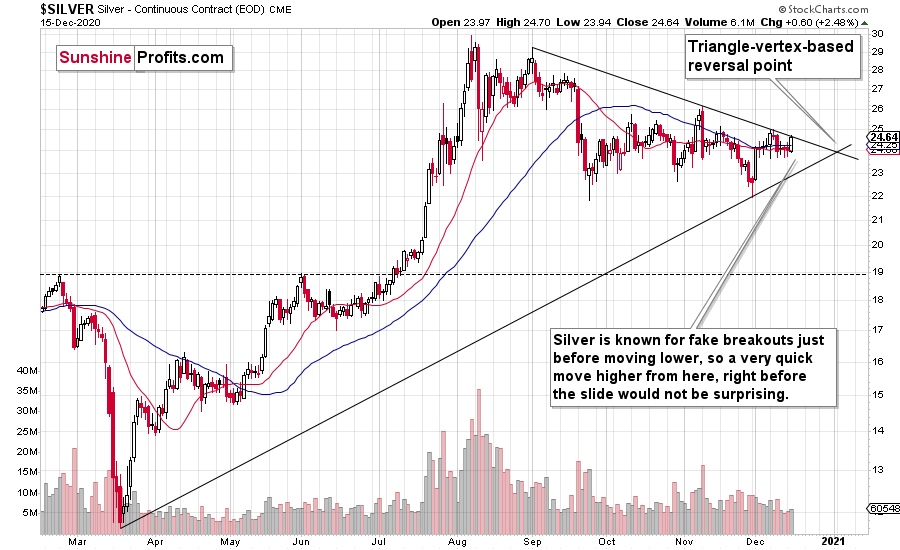

The white metal closed yesterday’s (Dec. 15) session right at its declining resistance line. It moved sharply higher today, soaring above both: its declining resistance line and its December high.

This is exactly what silver tends to do right before significant declines – it’s exceptionally strong – more than gold and mining stocks. Why would this be the case? Because silver is a relatively thin market, where many institutional investors can’t go as there’s not enough silver for them. The “big players” generally go for gold, and silver is favored by the investment public. The silver manipulation theories are making the demand among the investment public even stronger, and the investment public (as a general group, not any individual person) tends to enter the market close to the tops.

The above-mentioned factors – along with the relatively small size of the silver market – make the white metal perform very well (too well) near the local tops. Of course, this doesn’t work each and every time, just like any other trading technique, and one should also look for additional confirmations before making a trade (like weak miners , which tend to react differently than silver).

It does imply, however, that it’s best not to take silver’s strength at its face value, and definitely not to view it as bullish unless it’s confirmed by the rest of the precious metals sector. Today’s breakout in silver and lack thereof in gold is not a bullish development, but a bearish one.

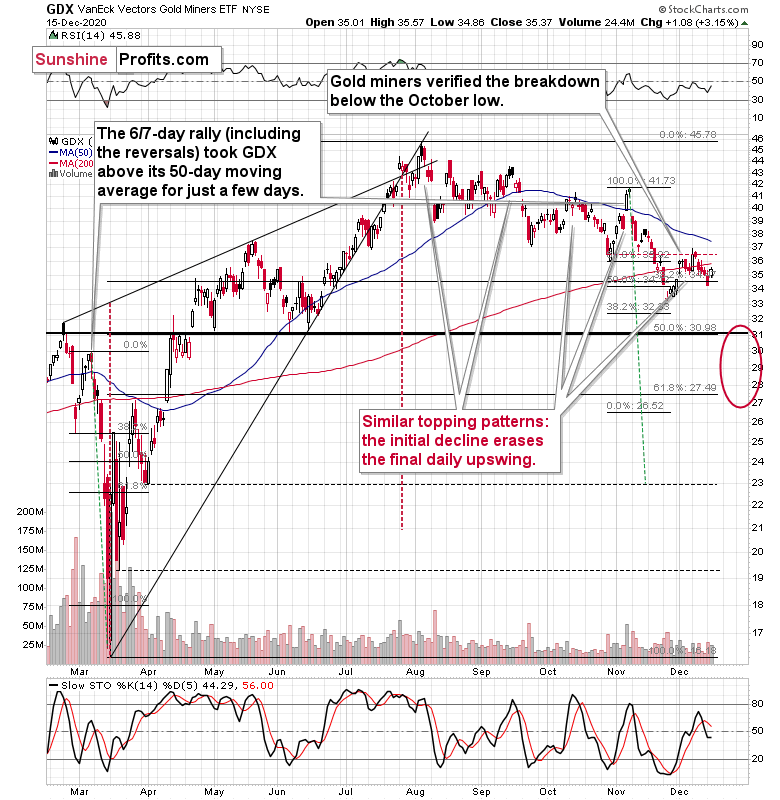

Moving on to the performance of the mining stocks, let’s take a look at the chart below.

The GDX ETF – proxy for precious metals mining stocks – moved higher yesterday, more than nullifying the previous day’s decline. But, overall, was it really strong? Absolutely not. In today’s trading on the London Stock Exchange, the GDX is up only a bit above Tuesday’s intraday highs, and it corrected only a bit more than a half of the December decline.

Simply put:

- Gold is relatively weak compared to what’s happening in the USD Index

- Silver is relatively strong to gold and breaking above the previous resistance levels without confirmations from neither gold, nor mining stocks

- Gold and silver mining stocks are weak compared to what’s happening in gold

The above is a perfectly bearish combination on the relative strength front. Combining this with USDX’s proximity to its target area makes the overall implications for the precious metals market very bearish.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the downside target for gold that could be reached in the next few weeks.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********