Building A Slam-Dunk Portfolio With Municipal Bonds

What do Johnny Unitas, Scottie Pippen and Mike Tyson all have in common?

What do Johnny Unitas, Scottie Pippen and Mike Tyson all have in common?

If you said they’re former professional athletes, you win a door prize. The answer I was looking for is that all three ended up in bankruptcy court as a result of poor spending habits, bad investment advice or both.

Legendary quarterback Unitas lost big investing in restaurants, bowling alleys and real estate. Former Chicago Bulls star Pippen faulted his law firm for misguiding his decision to invest in a private jet. Meanwhile, Tyson, the former heavyweight champion of the world, squandered the more-than-$300 million he earned during his boxing career.

They’re not the only ones. In 2009, Sports Illustrated estimated that 60 percent of NBA players face bankruptcy just five years after retiring. For those in the NFL, that figure jumps to 78 percent.

To be fair, almost all of us have made investment decisions that didn’t pan out the way we had hoped. But the ugly truth is that when you’re successful and wealthy, you become the target of fraudsters and schemers. Just this Monday, in fact, a financial advisor pleaded guilty in federal court to accusations that he was plotting to defraud several NFL players.

Being scammed out of your retirement money or having to declare bankruptcy is a terrible thing for anyone to have to go through. But keep in mind that the typical career of a professional athlete is relatively short, lasting between three and five years. That means you have approximately 50 years’ worth of retirement to plan for.

So where do you start?

A Method to Preserve Capital

For high-net worth investors, a popular strategy to grow retirement money and receive tax-free income is through investment-grade municipal bonds—the very kind our Near-Term Tax Free Fund (NEARX) owns.

It’s true that for those who enjoy the high roller lifestyle, muni bonds don’t seem nearly as sexy as other investments such as restaurants and private jets.

But there’s nothing sexier than money, which is exactly what NEARX seeks to preserve through a diversified portfolio of high-quality munis with relatively short maturities. As you can see below, the higher the bond rating, the less likely it is for the issuer to default. Eighty percent of NEARX’s holdings fall into one of the four highest ratings.

Many loyal readers are probably familiar with the following chart, which has been modified to reflect the investment goals of someone with a lot of wealth. If he or she were to have invested a hypothetical $1,000,000 into an S&P 500 index fund in January 2000, it would have taken almost 14 years for it to catch up to and surpass a similar investment in NEARX.

Although we can’t guarantee how the fund will perform in the future, NEARX has historically shown a greater likelihood of dodging the dramatic swings and volatility in the equities market, similar to the ones we experienced during the first decade of the century—the dotcom bubble, for instance, and the Great Recession. And there will be times, of course, when products such as an S&P 500 index fund will strongly outperform NEARX.

The fund holds five stars overall from Morningstar, among 173 Municipal National Short-Term funds as of 12/31/2014, based on risk-adjusted return. That’s one star for every championship title our San Antonio Spurs have brought home to the Alamo City.

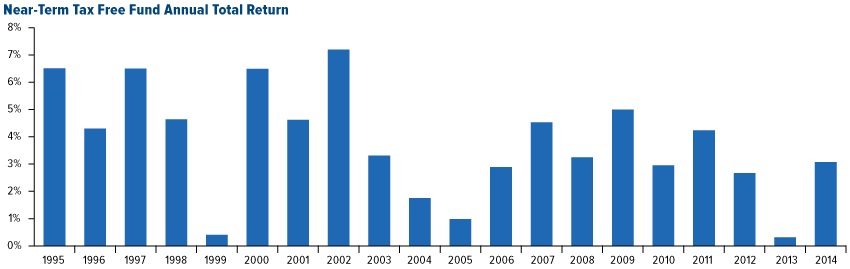

NEARX has also delivered an astounding 20 straight years of positive returns. For a majority of those years—since 1999—it’s been expertly managed by our director of research, John Derrick.

This is a rare achievement indeed.

So rare, in fact, that out of 25,000 equity and bond funds, only 30 have accomplished the same feat of delivering positive returns for 20 straight years, according to Lipper. As such, NEARX enjoys one of the most envied track records among its peers—just like the Spurs.

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at

Frank Holmes is the CEO and Chief Investment Officer of U.S. Global Investors. Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Mr. Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” Mr. Holmes is engaged in a number of international philanthropies. He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve conflict around the world. He is also an advisor to the William J. Clinton Foundation on sustainable development in countries with resource-based economies. Mr. Holmes is a native of Toronto and is a graduate of the University of Western Ontario with a bachelor’s degree in economics. He is a former president and chairman of the Toronto Society of the Investment Dealers Association. Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Visit the U.S. Global Investors website at