What Will Finally Break The Market's Lethargy?

To most individual traders, there is no bigger buzz kill than a narrow trading range. It takes the wind out of the sails of breakout and momentum traders, and even expert stock pickers have a tough time finding the stocks which are bucking the sideways trend.

Wall Street would much rather see a lively bull market when stocks are roaring and participation is widespread among all classes of investors. But sometimes even a trading range-type market is good enough for the Street, provided stock prices are near all-time highs. For even when prices are making no headway, the aggregate yield on stocks pays enough in dividends to make the lack of action worthwhile.

There are indeed enough listed companies which pay a high enough dividend to make buying and holding in a lackadaisical stock market an attractive proposition. This is one reason for the torpor which currently infuses not only the financial market, but the rest of the country as well. Why worry when you can sit back and live off the interest? Widespread lethargy breeds a range-bound stock market, but it also contributes to a sluggish economy. As we'll discuss here, there is a reason for the public's lethargy and within that reason lies the solution to the problem.

If you needed proof of the trading range-induced complacency out there right now, the public's response to the U.S. airstrike on Syria is a good example. While there was a modicum of shock and anger, the response to the military action was mostly lethargic. Even the stock market seemed unimpressed enough to rally, which underscores the extent of the public's complacency.

Even Congress is infected with the conservation bug. Even as President Trump touts his ambitious plan to cut taxes, the U.S. House majority leader is pouring water all over that plan by saying Congress will balance any proposed tax cuts by finding ways to increase revenues (read more taxes, but in different areas). Thus the old "paying Peter by robbing Paul" syndrome has infused America's elected leaders, who seem to afraid to risk anything like general prosperity.

One certainly can't fault the President for trying to break the lethargy that has dominated the economy in the last two years. His attempt at lifting the huge burdens imposed on the middle class by reforming Obamacare were spurned by Congress. His latest move appears aimed at stimulating the economy via military conflagration, a tried-and-true (short-term) economic palliative to be sure.

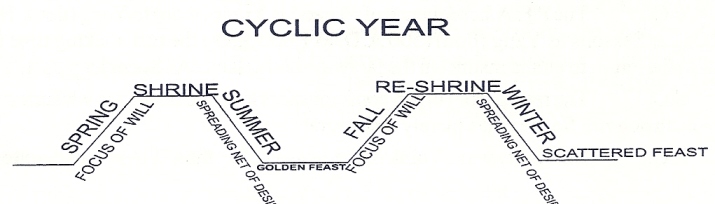

The subdued mood of the market can only be understood in terms of the long-term economic cycle, or K-wave. This cycle is divided into four "seasons" of economic activity over a period encompassing roughly 60 years. Each season approximates to 15 years. The winter season of the cycle was between 2000-2014/15, with the last 60-year cycle bottoming at the end of 2014. We're now in the early stages of K-wave spring, which should last until about 2029/30.

So if economic spring has sprung, what is keeping the economy from flourishing? The answer to that is best seen in a timely analogy. Even as the Northern hemisphere experiences the early phase of spring in April, there are still lingering signs of the previous winter. While most days are fairly warm, temperatures can still be sometimes chilly and even winter-like. It takes a while for a new season to fully establish itself while the vestiges of the preceding season gradually fade away. In like manner, it will probably take a few years for K-wave spring to become established -- especially given the severity of the K-wave winter season a few years ago.

The question everyone is concerned with is what will it take to finally break the psychological shackles which have held back profligate spending and retail-level investing? The answer to that question can be found in the previous paragraph: the immutable laws of the economic K-wave will eventually lay the foundation for a fundamental change in mass psychology.

At some point in the current K-wave spring season the zeitgeist of contraction and fiscal restraint will give way to expansion and liberality. Until then, expect to see occasional flare-ups of the winter mentality that predominated in the last decade. These flare-ups should become more and more infrequent, however, as the K-wave spring season gradually warms the blood and increases the animal spirits.

When K-wave spring finally hits full bloom, it will bring many economic benefits. There will be a few signs to watch for to let us know that spring has fully arrived. First and foremost, watch for higher yields on U.S. Treasury bonds. There is no surer sign that the long-term economic cycle is accelerating than rising bond yields.

As the new K-wave upward phase progresses we'll also see increasing real estate activity as prospective homebuyers and commercial builders alike look to lock in still-attractive mortgage rates before they get too high. As real estate timer Robert Campbell addressed in his latest newsletter (www.RealEstateTiming.com), US home prices have broken out of a two-year doldrums phase and are rising at their fastest pace since 2014. The momentum of real estate activity is on the upswing.

Finally, look for speculative interest in both stocks and commodities to increase on a large scale. Risk aversion is a lingering symptom of the contractionist psychology of the K-wave winter season. When K-wave spring blooms in full, however, investment activity will pick up as participants shed their anxieties and trade them in for a more optimistic outlook.

********

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today’s fast-moving and sometimes volatile market environment. If you’re interested in moving average trading techniques, you’ll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies For Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter:

http://www.clifdroke.com/books/masteringma.html

Clif Droke is a recognized authority on moving averages and internal momentum. He is the editor of the Momentum Strategies Report newsletter, published since 1997. He has also authored numerous books covering the fields of economics and financial market analysis. His latest book is Mastering Moving Averages. For more information visit www.clifdroke.com