Global Central Banks Move To Keep The Party Rolling (Part IV)

In this last segment of our multi-part research post regarding the US Fed and the global central banks, it is becoming evident that the fear of a further market contraction is resulting in the decrease in rates and the push for additional QE functions. Our research has shown that the global economy has partially recovered from the 2008-09 credit market collapse, but the process of the recovery has resulted in a “blowout” type of event where shifting capital intents and the transition from the 19th century economic model towards a new 21st century economic model is setting up the global markets for a massive rotation event over the next 12 to 24 months – possibly longer.

It is our belief that capital is still doing what capital always does, seeking out the best opportunities for safety and returns. Right now, that location is easily found in only certain segments of the markets; volatility, precious metals, certain energy sectors, US Treasuries and CASH. The future events, including the massive rotational event that we believe is about to unfold in the global markets, will change the way capital is deployed for many years to come. It is very likely that this rotation event will create incredible opportunities for skilled technical traders over the next 12 to 36 months and will likely prompt a further shift towards the new 21st-century economic model that we believe will be the ultimate outcome.

Taking a brief look at our recent history highlights the fact that capital becomes fearful about 12 to 16 months before a major US election event. Additionally, certain other factors related to the global economy heighten this fear as US/China trade issues, global debt issues and economic output issues continue to plague the markets. The combination of these types of events set up a “perfect storm” type of economic cycle where skilled technical traders are just waiting for the impact event to hit before the markets begin a bigger rotational event.

These types of events, similar to the 2000 and 2008-09 market crash event, are a process where price rotates out of a normal range and attempts to explore lower price levels that act as price support. It is not uncommon for these types of events to happen, although the severity of these events is difficult to determine prior to their execution.

The US Fed and global central banks set up an easy money process over the past 9+ years that allowed for capital to be deployed as a process that has setup this current massive rotational event. At first, the intent was to support collapsing markets and institutions – we understand that. But the nature of capital is to always seek out suitable safety and returns, so capital did what is always does hunt out the best opportunities for profits. First, it rallied into the crashing real estate market and emerging markets – which had been crushed by the 2008-09 credit crisis event. Next, it piled into the Asian markets and healthcare/technology markets. At this time, it also started piling into the startup/VC markets throughout the world as well as certain commodities. The recovery seemed to have created a booming and cash-flush market for anyone with two dollars to rub together.

Then came the 2015-16 market contraction and the end of the US Fed QE processes. At this time, China realized the need to control capital outflows and the US/Global markets slowed to a crawl as the US Presidential election cycle ramped-up. It was just 12 months prior to this 2015-16 event that oil crashed from $114 to $46. Within 2015-16, Oil continued to crash to levels below $30. This was the equivalent of the blowout cycle for the global economy. Headed into the 2016 US elections, the global economy was running on only 5 of 8 cylinders and was limping along hoping to find some way out of this mess.

The November 2016 US elections were just what the global economy needed and everyone's perceptions about the future changed almost overnight. I remember watching the price of Gold on election night; +$75 early in the evening as Clinton was expected to win, then it continued to fall back to +$0 fairly late in the evening, then it fell to -$75 as the news of a Trump win was solidified. This rotation equated to a nearly 10% rotation in less than 24 hours based on FEAR. Once fear was abated, global investors and capital went to work seeking out the safest environments and best returns – like normal.

This resurgence of capital into the markets set up of a new SOP (standard operating procedure) where capital began to be deployed in more risky environments and into broader and bigger investment structures. This is the SETUP I'm trying to highlight that was created by the US Fed and central banks. I don't believe anyone thought, at that time in early 2017, that the current set of events would have transpired and I believe global governments, central banks, and global financial institutions thought, “Party on, dude! We're back to 2010 all over again”. Boy, were they wrong.

This time, the global central banks, governments and state-run enterprises engaged in bigger and more complex credit/debt structures while attempting to run the same game they were running back in 2010 and 2011. The difference this time is that the US Fed started raising Fed Fund Rates and destroyed the US Dollar carry trade while putting increasing pressure on the global market, global debt and global trade. The continued rally of the US Dollar after the 2018 lows helped to solidify the advantages and risks in the markets. This upside rally in the US Dollar, after the 2014 to 2016 rally, really upset the balance of the global markets and setup an increasing pressure point for foreign markets.

It soon became very evident that risks in the foreign markets could be partially mitigated by investing in the US stock market and by moving capital away from risky currencies and into US Dollar based assets. Capital is always doing what it always does – seeking out the best environment for returns and protection from risk. Thus, we have the setup right now – only 15 months before the 2020 US Presidential elections. What happens now?

This setup is likely to prompt a rotation in the global markets as well as within the US stock market. It is very likely that a continued contraction in consumer and banking activity (think business, real estate, trade, commodities, and others) will prompt a contraction in global economics very similar to what happened in 2014~2016. This process will likely put extreme risk factors at play in some of the most fragile economies and state-run enterprises on the planet. Once the flooring begins to crack in some of these markets, we'll see how this event will play out. Right now, our eye is watching Europe and Asia for early warning signs.

The US Fed will continue to manipulate the FFR levels in an attempt to help mitigate the risks associated with this contraction event. It is likely that the US Fed already sees what we see and it attempting to position themselves into a more responsive stance given the potential outcomes. Inadvertently, the US Fed and global central banks presented an offer that was too good for anyone to ignore – easy cash. What they didn't expect is that the 2014 to 2019 rally in the US Dollar and US stock market would transition capital deployment within the global market in such a way that it has – setting up the current event cycle.

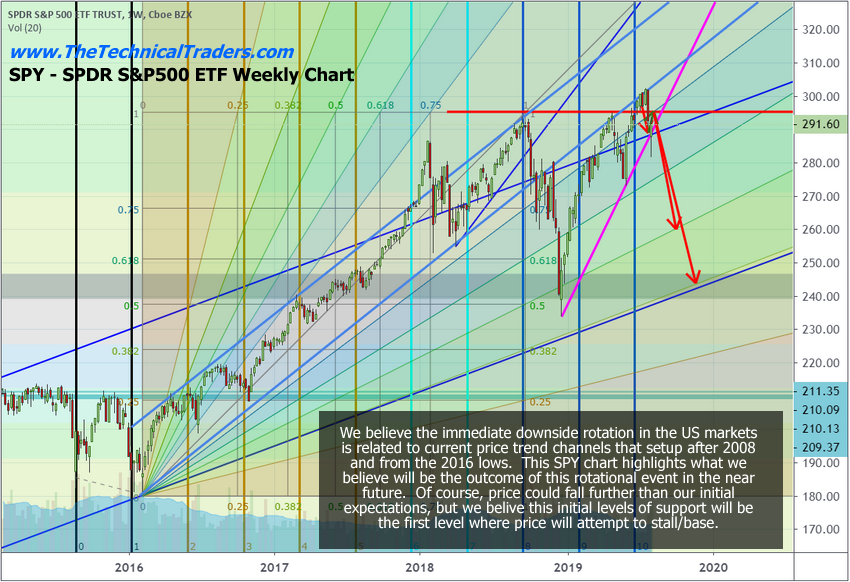

We believe a downside pricing event is very likely over the next 10 to 25+ days where the US stock market may fall 12 to 25%, targeting levels shown on this chart (or slightly lower) as this rotational event takes place. Ultimately, the US markets will recover much quicker than many foreign/global markets. Our estimates are that the recovery in the US markets will likely begin to take place near March or April 2020 and continue higher beyond this date.

This Custom Smart Cash Index chart highlights the type of capital shift activity we've been describing to our readers and followers. It is easy to see that capital moved out of risky investments within the downturns on this chart and into the most opportunistic equity markets within the uptrends on this chart. Remember, most opportunistic markets are sometimes outside of the scope of this Smart Cash index. For example, this chart does not relate strength in the Precious Metals markets or other commodities/currencies. All this chart is trying to highlight for followers is how capital is being deployed in viable global equity markets and when capital is exiting or entering these markets.

Given the current setup, we would expect a breakdown in this Smart Cash Index over the next 4+ months to set up a new lower price level establishing a base/bottom before attempting to move higher. We believe the 100 level, shown as historical support, is a proper target price level for this move initially.

Lastly, we believe capital is moving aggressively into the precious metals markets and we urge all skilled technical traders to pay attention to this chart of the Gold/Silver ratio. If our analysis is correct and a larger rotation price cycle is about to unfold in the global markets, which may last well into 2020 (or beyond) for certain global markets, then you really need to pay attention to the upside potential for this Gold/Silver ratio.

As we've drawn on this chart, if this ratio recovers to 50% of the 2011 peak levels as this rotation unloads on the global market, this would push Gold and Silver prices to levels potentially 60% to 140%+ higher than current levels. I understand how hard it is to understand these types of incredible price increases and how they could possibly be relative to current prices, but trust us in our research. Gold and Silver prices have been measurably depressed over the past 3 to 4 years. Unleashing the real valuation levels of these precious metals at a time when risk factors are excessive suggests that Gold could easily be trading above $3200 and Silver above $60 to $65 within 6 to 12 months.

CONCLUDING THOUGHTS

In closing, we want to urge all skilled technical traders to keep a very open perspective to the “Party on, Dude” mode of the global central banks and be aware that a very fragile floor is the only thing holding up the markets in another massive US presidential election cycle event. In our opinion, the writing is already on the wall and we are preparing for this rotational event and alerting our members on what to do to profit from these moves.

The Federal Reserve and global central banks will attempt to keep the party rolling for as long as possible because they know the downside event could be something they don't want to have to deal with. So watch how these global central banks attempt to nudge public perception away from risks and towards the “party on” mode. Stay alert. Stay aware. When this breaks, it will break quickly and aggressively.

Using technical analysis and proven strategies we can follow the market trends and profit from them no matter which the market moves. We bet with the market (the house) and provide entry, target, and stops for all trades we initiate.

NEXT MOVES FOR GOLD, SILVER, MINERS, AND S&P500

In early June I posted a detailed video explaining in showing the bottoming formation and gold and where to spot the breakout level, I also talked about crude oil reaching it upside target after a double bottom, and I called short term top in the SP 500 index. This was one of my premarket videos for members it gives you a good taste of what you can expect each and every morning before the Opening Bell. Watch Video Here.

Detailed report talking about where the next bull and bear markets are and how to identify them. This report focused on gold miners and the SP 500 index. My charts compared the 2008 market top and bear market along with the 2019 market prices today. See Comparison Charts Here.

We posted that silver was likely to pause for a week or two before it took another run up on June 26. This played out perfectly as well and silver is now head up to our first key price target of $17. See Silver Price Cycle and Analysis.

I warned that the next financial crisis (bear market) was scary close, possibly just a couple weeks away. The charts I posted will make you really start to worry. See Scary Bear Market Setup Charts.

JOIN ME AND TRADE WITH A PROVEN STRATEGY TODAY!

*********