Markets: Keep Calm And Carry On

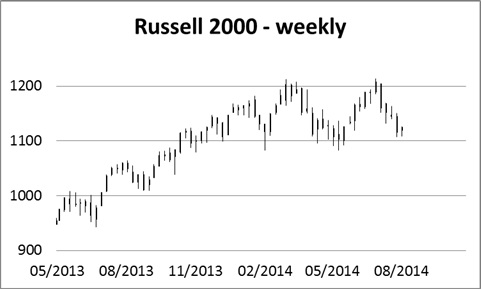

At the end of July global equity bull markets had a moment of doubt, falling three or four per cent. In the seven trading days up to 1st August the S&P500 fell 3.8%, and we are not out of the woods yet. At the same time the Russell 2000, an index of small-cap US companies fell an exceptional 9%, and more worryingly it looks like it has lost bullish momentum as shown in the chart below. This indicates a possible double-top formation in the making.

Meanwhile yield-spreads on junk bonds widened significantly, sending a signal that markets were reconsidering appropriate yields on risky bonds.

This is conventional analysis and the common backbone of most brokers' reports. Put simply, investment is now all about the trend and little else. You never have to value anything properly any more: just measure confidence. This approach to investing resonates with post-Keynesian economics and government planning. The expectations of the crowd, or its animal spirits, are now there to be managed. No longer is there the seemingly irrational behaviour of unfettered markets dominated by independent thinkers. Forward guidance is just the latest manifestation of this policy. It represents the triumph of economic management over the markets.

Central banks have for a long time subscribed to management of expectations. Initially it was setting interest rates to accelerate the growth of money and credit. Investors and market traders soon learned that interest rate policy is the most important factor in pricing everything. Out of credit cycles technical analysis evolved, which sought to identify trends and turning points for investment purposes.

Today this control goes much further because of two precedents: in 2001-02 the Fed under Alan Greenspan's chairmanship cut interest rates specifically to rescue the stock market out of its slump, and secondly the Fed's rescue of the banking system in the wake of the Lehman crisis extended direct intervention into all financial markets.

Both of these actions succeeded in their objectives. Ubiquitous intervention continues to this day, and is copied elsewhere. It is no accident that Spanish bond yields for example are priced as if Spain's sovereign debt is amongst the safest on the planet; and as if France's bond yields reflect a credible plan to repay its debt.

We have known for years that through intervention central banks have managed to control the prices of currencies, precious metals and government bonds; but there is increasing evidence of direct buying of other financial assets, including equities. The means for continual price management are there: there are central banks, exchange stabilisation funds, sovereign wealth funds and government-controlled pension funds, which between them have limitless buying-power.

Doubtless there is a growing band of central bankers who believe that with this control they have finally discovered Keynes's Holy Grail: the euthanasia of the rentier and his replacement by the state as the primary source of business capital. This being the case, last month's dip in the markets will turn out to be just that, because intervention will simply continue and if necessary be ramped up.

But in the process, all market risk is being transferred from bonds, equities and all other financial assets into currencies themselves; and it is the outcome of their purchasing power that will prove to be the final judgement in the debate of markets versus economic planning.