Silver Forecast: The White Metal’s Major Signal

Silver's recent upward move was most likely just a corrective upswing. What usually happens after such adjustments are completed?

Prices tumble.

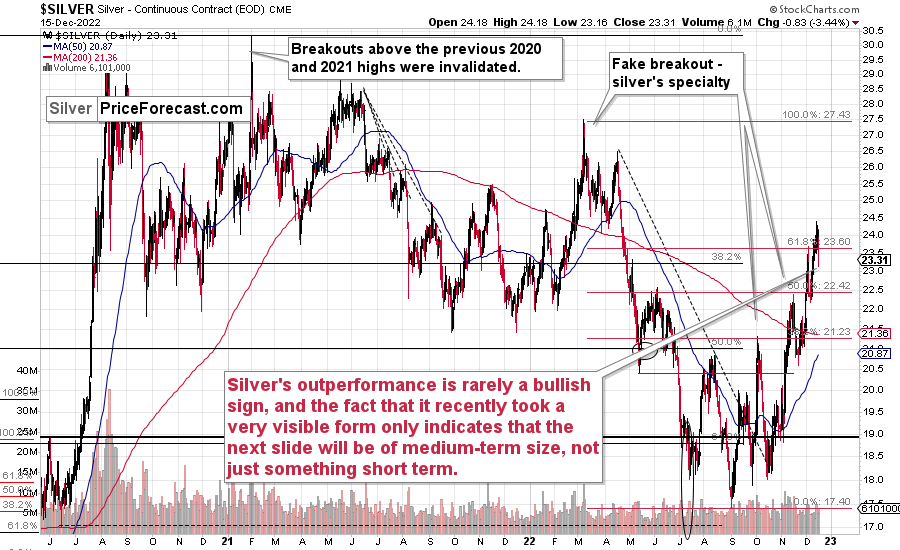

As I emphasized many times before, silver's outperformance is rarely a bullish sign, and the fact that it recently took a very visible form only indicates that the next slide will be of medium-term size, not just something short term.

Why would silver’s outperformance be a bearish sign at all?

First of all, because the history shows that it worked numerous times.

Second, the silver market is much smaller, and it’s much popular with individual investors / investment public. The institutions simply can’t buy a lot of silver without moving the market, so they are not that interested in it – besides, it hasn’t performed well in the past decade. Individual investors, however, can usually freely enter the silver market, and due to multiple reasons, they often do.

The thing is that the investment public is often the last to the party – individual investors often buy close to tops, and they sell close to bottoms.

And you can see this in the price movement – silver soars relative to gold close to tops in their prices.

In other news, silver just invalidated its temporary breakout above the 61.8% Fibonacci retracement.

Yes, that’s a retracement that’s higher than the analogous ones in stocks, gold, crude oil, and mining stocks, and… This is yet another confirmation of silver’s short-term strength.

Once again – it’s not something bullish, but very likely something bearish.

This means that the recent sizable rally is nothing more than a – sizable, but still – correction within a bigger downtrend.

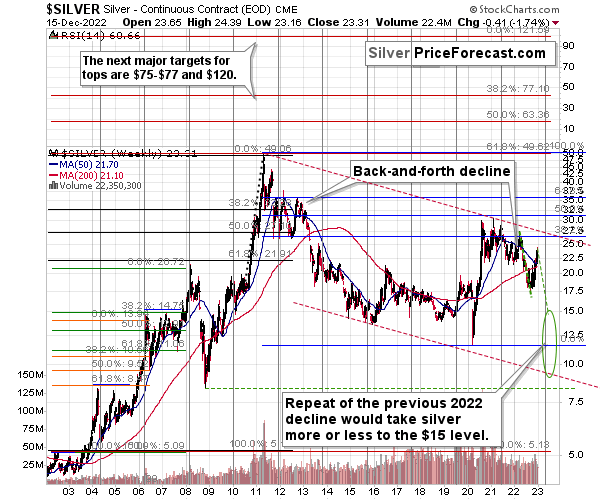

Looking at silver from a long-term point of view helps to see the forest, not just individual trees.

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

What happens after corrections are over (as indicated by, i.e., silver’s outperformance)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Besides, the long-term turning point for silver is due in several months, and if silver repeats its previous 2022 decline, then it will bottom close to the turning point and also close to the $15 level– in the first half of 2023.

It’s likely to repeat its previous 2022, because that’s what tends to happen after flag patterns, and what you see on silver’s short-term chart between September and yesterday appears to be a flag pattern.

However, will silver only repeat its previous 2022 performance and not decline more than it already has?

Based on the analogies to 2008 and 2013, the latter is more likely. The 2013 slide was bigger than the initial decline that we saw in 2012. And the final 2008 slide was WAY bigger than what we saw before it.

Due to its industrial uses, silver is known to move more than gold, in particular when the stock market is moving in the same way as gold does. Since I think that gold and stocks are both likely to slide, silver is indeed likely to decline in a truly profound manner. Quite likely lower than just $15.

Consequently, my prediction for silver prices remains bearish, as does the outlook for the rest of the precious metals sector.

Summing up, it seems that the major bottom in the USD Index is in, while the correction in stocks, gold, silver, and mining stocks is over.

The excuse that markets used to correct this time was an incorrect (in my view) expectation that the Fed is going to make a dovish U-turn. However, as the irrationality ends, the medium-term trend is likely to resume. And, in my view, this trend – in precious metals and mining stocks – is down.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free silver newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********