Silver Miners: Top Risk-Reward For 2021 (Part 1)

Summary

Summary

- Written by my favorite risk/reward silver miners for 2021.

- They each have low valuations versus their upside potential at higher silver prices.

- They each have quality properties with long-life mines.

- All of them have exceptional leverage to higher silver prices.

Currently, silver prices have been stuck in a trading range since August. In fact, we probably have not found the bottom yet. For this reason, now might not be the perfect time to buy. But there are some investors who are buying the dip since August or are preparing to buy the dip (if one arrives).

I think that silver will find a bottom in Q2 (or perhaps Q3), so now is a good time to create a list of stocks to buy when the dip comes. Why Q2? Because the stock market is getting toppy and is overdue for a correction. Once this correction occurs, I think the risk-on trade that has been all the rage for the past year will finally end. That will flip sentiment, and silver will finally end this correction cycle and head higher.

At this time, everyone wants technology stocks, crypto, or other industrial stocks, and are avoiding the miners. But I don’t think this is 2013 all over again, when gold and silver crashed, and the stock market surged. Instead of a 2013-like crash, my expectation is that silver will hold somewhere between $20 and $23, and we will find a bottom. It’s possible we could re-test $18.50, but that’s not my expectation.

Once silver finds a bottom, I expect a big run. Actually, a huge run. This run should take us to a new ATH above $50. Thus, we should see $40 or perhaps even $50 in 2021. I expect this run to begin in either Q2 or Q3.

If we get a run in silver this year, the silver miners will do extremely well. Since miners are out of favor, they have huge leverage to higher silver prices. Many of the stocks in this article will rise 50% or more in a single week during this run. Big moves will be common for these stocks.

Potential Risk

While I expect silver to put in a bottom and then head higher, there is always the chance that silver simply trends lower. If this occurs, then the silver miners will get pounded. We know this because investors have shown very little patience to hold their positions when silver prices drop. Thus, there is extreme volatility in this sector. As the saying goes, with big upside potential comes big downside risk.

The two significant risks for silver are a strong recovery or a lethargic gold price. If the economy recovers and inflation is flat, then silver could get stuck or get battered down. Also, unless gold joins the party, silver is not likely to break out on its own. In my opinion, gold has to lead. Thus, unless gold begins to trend, silver is not likely to trend either.

The one thing that is bullish for silver is its technical chart. If silver closes over $28, the odds favor a new intermediate high at $30. And once you get above $30, the last significant resistance before $50 is $35. Thus, once we get over $30, there is very little resistance for a run from $30 to $50 to a new ATH.

Stocks Included

The stocks included in this article all have high upside potential with higher silver prices. These are the highest quality silver miners and my favorite silver stocks. That said, they have high risk because they are dependent on silver prices not falling. Thus, they are a bet on higher silver prices.

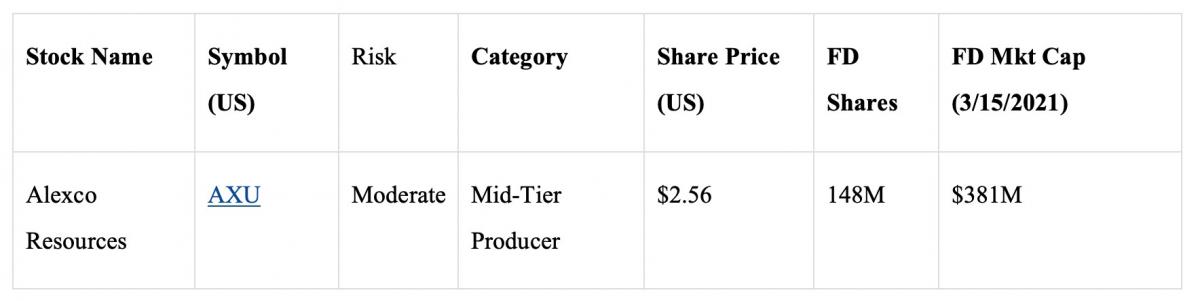

Alexco Resources

Description

Alexco Resources was a silver producer in the Yukon until 2014. They were producing 1.5 million oz. annually at their Bellekeno mine. High costs forced them to put it on care & maintenance. They have an excellent 55,000 acre property (Keno Hill) located in Canada. It is a 100 million oz. resource at 500+ gpt., plus lead and zinc offsets. However, they only get 75% of the silver revenue, the rest goes to Wheaton

Precious Metals as a streaming deal to finance the original mine.

They are projecting all-in costs (free cash flow) around $13 to $14 per oz. after expanding annual production capacity to 4 million oz. The capex is about $23 million for the expansion, with a 70% after-tax IRR at $16 silver. They have about $15 million in cash and no debt, so it will be easy to finance. In fact, they already have a $15 million loan agreement. They should begin construction for their expansion in 2020. It is a 7-month project. They should begin production in 2020, as long as silver prices are above $16.

Their FD market cap has jumped to $381 million, but it appears to still be cheap. The one red flag is their streaming deal with Wheaton Precious Metals. They are obligated to give 25% of their Keno Hill production to Wheaton for the life of the mine. Wheaton pays them a calculated amount until silver prices reach $25, then they pay them nothing. Alexco gets more money if silver is cheaper, but nothing above $25! Basically, Alexco is protected for silver prices under $17. However, after silver gets above $20, they get very little money from Wheaton and zero after silver reaches $25. This is a terrible deal for Alexco and will force them to pay for 25% of production with zero revenue. This will have the effect of increasing their costs for the remaining 75%.

One strong positive about this stock is their exploration potential. The grades on this property are excellent. I'll be surprised if they don't reach at least 5 million oz. of production. Another thing to like is their cash flow at higher silver prices. Also, without any debt, they will be in a position to grow via acquisitions once silver prices rise. While it does look a bit pricey today, if they build or acquire another mine, it could become a big company.

Update: They restarted production in late 2020.

Details

Mine Locations: Canada (Yukon)

Cash: $15 million

Debt: $15 million

Breakeven Costs Per Oz. (current/future): $16/$16

Current Free Cash Flow: $25 million

Current Free Cash Flow Multiple vs FD Mkt Cap: 17

Future Silver Reserves: 60 million oz. (500 gpt.)

Future Silver Production: 4 million oz.

Future Free Cash Flow ($100 silver): $175 million

Future Silver Oz. / FD Mkt Cap: $6.36

Future Mkt Cap Growth ($100 silver): 300%

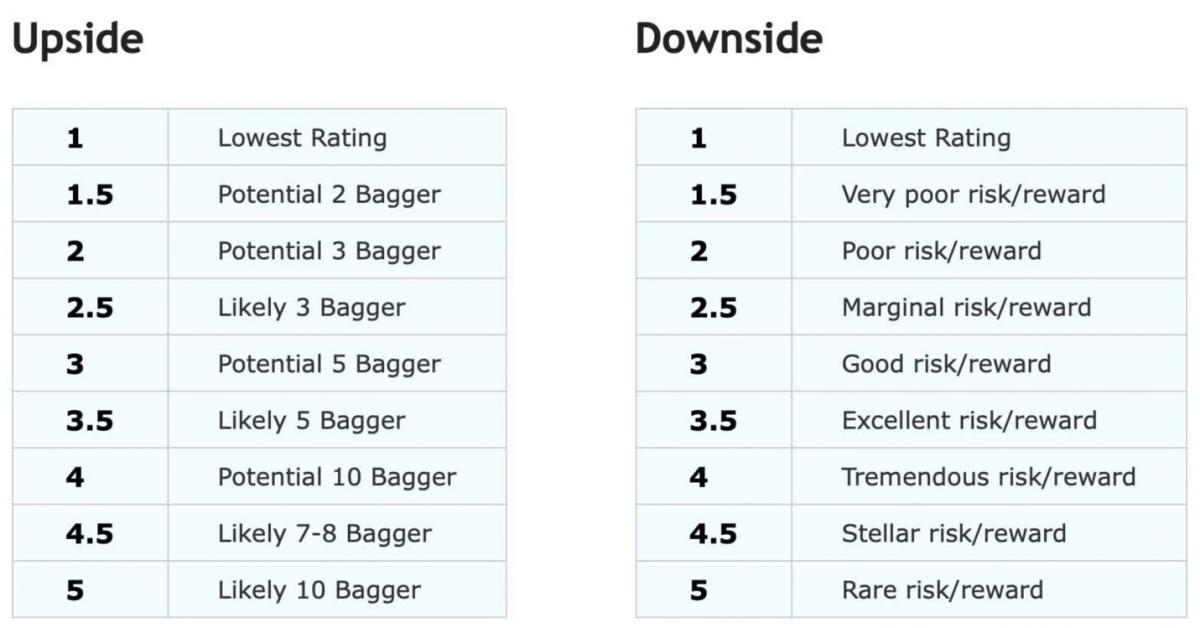

Upside/Downside Rating: 2.5/3.5

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 7.5

Costs/Grade/Economics: 7.5

People/Management: 7

Cash/Debt: 7

Location Risk: 8.5

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 6.5

Overall Rating: 7

Detail/Scorecard Comments

Investors like it, giving it around a 15x multiple. If they get a 15x multiple for their future free cash flow, then it is cheap.

Strengths: Good location, rare long-life economic high-grade silver mine in Canada, and strong exploration potential.

Weaknesses: A bit pricey, lack of growth projected, management is not stellar, single property companies are vulnerable to a takeover.

Aurcana Silver Corp

Description

Aurcana Silver Corp is scheduled to be a silver producer in Colorado in 2021 (RV Mine). They recently obtained a $28 million loan and raised money through share dilution. Production should ramp up to 3 million oz. (AGEQ) with all-in costs around $15 per oz. (probably much higher).

The RV mine has about 40 million oz. (AGEQ), plus significant exploration potential. Management is excited by their drill targets and expects to increase the mine life, as well as potentially increase production.

They also have their Shafter mine (18 million oz. at 240 gpt.) in Texas, which is on care and maintenance. They can resume production at around 1.5 million oz. per year. The capex to resume production is $20 million. They will need about $30 silver to restart the mine. I expect them to resume production at Shafter in 2022 or 2023 if silver prices rise.

Aurcana is no longer super cheap, but it still has significant upside potential. The key to their upside will be hitting their cost targets, which could be missed due to narrow veins, as well as exploration success. I like the stock because of the exploration potential at the RV mine.

Note: I have their future all-in costs at $18 per oz. (AGEQ). In 2021, it should be closer to $15 per oz., but those costs will increase if they add their Shafter mine.

Details

Mine Locations: USA (Colorado, Texas)

Cash: $14 million

Debt: $35 million

Breakeven Costs Per Oz. (current/future): ?/$18

Current Free Cash Flow: N/A

Current Free Cash Flow Multiple vs FD Mkt Cap: N/A

Future Silver Reserves: 45 million oz. (700 gpt.)

Future Silver Production: 4 million oz.

Future Free Cash Flow ($100 silver): $196 million

Future Silver Oz. / FD Mkt Cap: $4.15

Future Mkt Cap Growth ($100 silver): 600%

Upside/Downside Rating: 3/3.5

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 7.5

Costs/Grade/Economics: 7.5

People/Management: 6.5

Cash/Debt: 7

Location Risk: 8.5

Risk-Reward: 7

Upside Potential: 8

Production Growth Potential/Exploration: 8

Overall Rating: 7.5

Detail/Scorecard Comments

What makes this stock exciting is their exploration potential. Management is excited about they expect to find on the RV Mine.

Strengths: Good location, long-life economic high-grade silver mine, and strong exploration potential.

Weaknesses: Management team is not strong, and single property companies are vulnerable to a takeover.

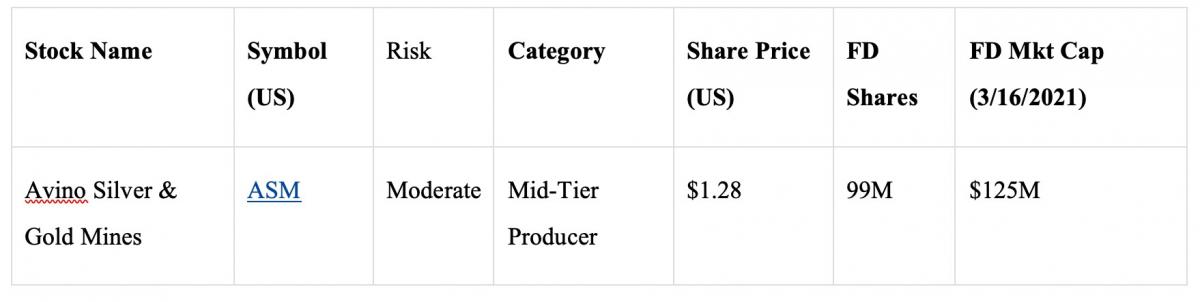

Avino Silver & Gold Mines

Description

Avino Silver & Gold Mines is an emerging mid-tier silver producer in Mexico. They will produce about 2.5 million oz. of silver equivalent in 2021 with all-in costs around $19 per oz. (free cash flow). Their costs were high in 2020 due to COVID, but I expect them to come back down in 2021. We will have to keep an eye on their costs.

They think they can increase production to 4 million oz. (silver equivalent) and reduce costs over the next two years. They have about $3 million in debt and about $12 million in cash, with only 99 million FD shares.

Management has a lot of experience. I look for this stock to be a 5+ bagger long term at higher silver prices. I was concerned with their resources, but they increased their M&I resources by 60% to 75 million oz. in 2020. This created good news for investors.

They are going to need to be successful with exploration at their Avino/San Gonzalo mines to grow production. The other red flag is the dependence on base metals for their revenue. About 65% of their revenue is from silver and gold. Even with their red flags, with an FD market cap of $138 million, the risk/reward looks very good for the long term.

Details

Mine Locations: Mexico

Cash: $12 million

Debt: $3 million

Breakeven Costs Per Oz. (current/future): $19/$19

Current Free Cash Flow: 12

Current Free Cash Flow Multiple vs FD Mkt Cap: 10

Future Silver Reserves: 75 million oz. (120 gpt.)

Future Silver Production: 3.5 million oz.

Future Free Cash Flow ($100 silver): $170 million

Future Silver Oz. / FD Mkt Cap: $1.67

Future Mkt Cap Growth ($100 silver): 1,000%

Upside/Downside Rating: 3.5/3.5

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 7

Costs/Grade/Economics: 6.5

People/Management: 6.5

Cash/Debt: 7

Location Risk: 7

Risk-Reward: 7

Upside Potential: 8

Production Growth Potential/Exploration: 7

Overall Rating: 7

Detail/Scorecard Comments

Strengths: Good entry price with high upside potential.

Weaknesses: Management team is not strong, single property companies are vulnerable to a takeover, growth is somewhat limited.

Coeur Mining

Description

Coeur Mining has underperformed since 2006. They have to reach $70 per share just to get back to where the share price traded in 2006. However, they have been aggressive, purchasing Orko Silver, Paramount Gold, and a mine from Gold Corp. Plus, they tend to have a weak balance sheet, which is currently $450 in debt and only $150 million in cash.

If they can clean up their balance sheet, their share price should take off. But they tend to be spenders and not shareholder friendly. Also, they like to hedge, with almost a third of gold production hedged in 2020. Even with these negatives, it’s a stock you probably have to own because their leverage to higher gold/silver prices.

In 2020, they will produce about 12 million ounces of silver and 350,000 ounces of gold. That is substantial and with rising gold and silver prices, cash flow could reach $1 billion annually at higher gold/silver prices. At 10x cash flow, they could reach a $10 billion market cap. That would make them a potential 3+ bagger from their current $2.4 billion FD market cap. The stock had been surging, rising from $2.48 to $14.94 in 2016, but is now down to $9.81 because of high costs and not a great balance sheet.

They are currently producing about 35 million oz. of silver equivalent (including gold), with all-in costs (free cash flow) around $16 per oz. So, they are a high-risk investment at low gold and silver prices. However, if gold and silver prices take off, they will benefit big-time.

I look for this stock to do well, although they need to find some production growth. They have become mostly a gold producer, with more revenue from gold than silver. However, that could even out if silver outperforms gold. The best thing about this company is that 96% of their revenue is from gold and silver, and very little from base metals.

Details

Mine Locations: USA, Canada, Mexico, Argentina

Cash: $153 million

Debt: $443 million

Breakeven Costs Per Oz. (current/future): $17/$18

Current Free Cash Flow: $180 million

Current Free Cash Flow Multiple vs FD Mkt Cap: 13

Future Silver Reserves: 400 million oz. (75 gpt.)

Future Silver Production: 35 million oz.

Future Free Cash Flow ($100 silver): $1 billion

Future Silver Oz. / FD Mkt Cap: $6

Future Mkt Cap Growth ($100 silver): 200%

Upside/Downside Rating: 2.5/3

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 8

Costs/Grade/Economics: 6.5

People/Management: 8

Cash/Debt: 7

Location Risk: 7.5

Risk-Reward: 7

Upside Potential: 6.5

Production Growth Potential/Exploration: 7

Overall Rating: 7

Detail/Scorecard Comments

Until recently, Coeur was cheap. It has jumped it bit in value reflecting that we are entering a bull market. I still like it as a potential 3 bagger.

Strengths: Tends to perform well during bull markets. Strong properties.

Weaknesses: Pricey. Limited growth potential. Low grade silver. Costs are high.

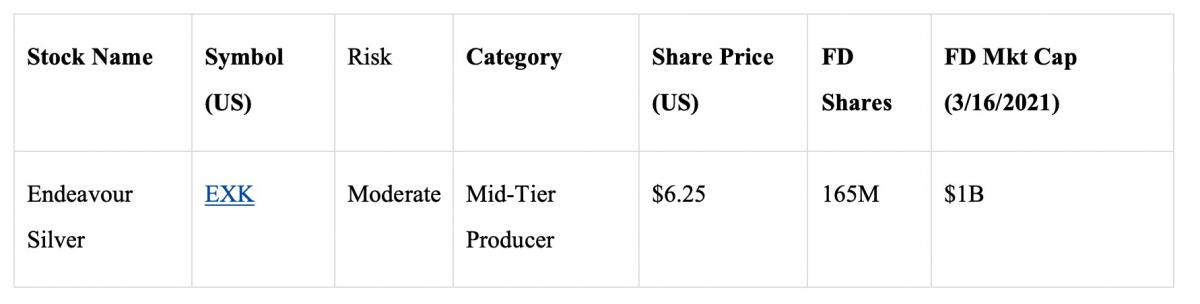

Endeavour Silver

Description

Endeavour Silver is a silver/gold producer in Mexico. They have 3 high-grade silver/gold producing mines, with expected production of 6.5 million oz. (silver equivalent including gold) in 2021. They are expanding production and reserves, projecting 9.5 million oz. (silver equivalent) by 2023. They have high cash costs ($12 per oz.) and high all-in costs (free cash flow) around $22 per oz. But their next two mines have lower cash costs and should reduce their all-in costs.

They have $45 million in cash and $7.5 million in debt. I'm somewhat surprised that their share price has held up with their high costs. But investors like their growth potential and they are one of the few pure silver/gold miners with no base metals. They produce about 35,000 oz. of gold.

Strong silver producers like Endeavour could really fly if we have a mania in mining stocks, because there are so few pure silver/gold producers. Look for Endeavour to use their cash flow and exploration to grow production. The only thing that could fatally hurt them is sub $15 silver prices for an extended period. However, they can raise money both from an equity financing or using debt to survive. They can also put a mine or two on care and maintenance (that would hurt their share price).

I'm not that concerned about them surviving for the long term. This is a company that should thrive with silver prices over $20. They plan to grow production to at least 10 million oz. of silver equivalent. I consider them a growth stock, although they are not cheap.

Details

Mine Locations: Mexico

Cash: $45 million

Debt: $7 million

Breakeven Costs Per Oz. (current/future): $22/$20

Current Free Cash Flow: $20 million

Current Free Cash Flow Multiple vs FD Mkt Cap: 52

Future Silver Reserves: 100 million oz. (200 gpt.)

Future Silver Production: 8 million oz.

Future Free Cash Flow ($100 silver): $384 billion

Future Silver Oz. / FD Mkt Cap: $10

Future Mkt Cap Growth ($100 silver): 200%

Upside/Downside Rating: 2.5/3

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 7

Costs/Grade/Economics: 6.5

People/Management: 7.5

Cash/Debt: 7.5

Location Risk: 7

Risk-Reward: 7

Upside Potential: 6.5

Production Growth Potential/Exploration: 7

Overall Rating: 7

Detail/Scorecard Comments

I’m surprised that investors love this stock. The current multiple is 52! That’s crazy, considering they have high costs and not much of a pipeline. Could you imagine if a stock like First Majestic Silver was valued at 52 free cash flow multiple when silver reaches $100? A normal multiple for a quality mid-tier producer is around 15.

Strengths: Tends to perform well during bull markets. Strong properties.

Weaknesses: Pricey. Limited growth potential. Costs are high.

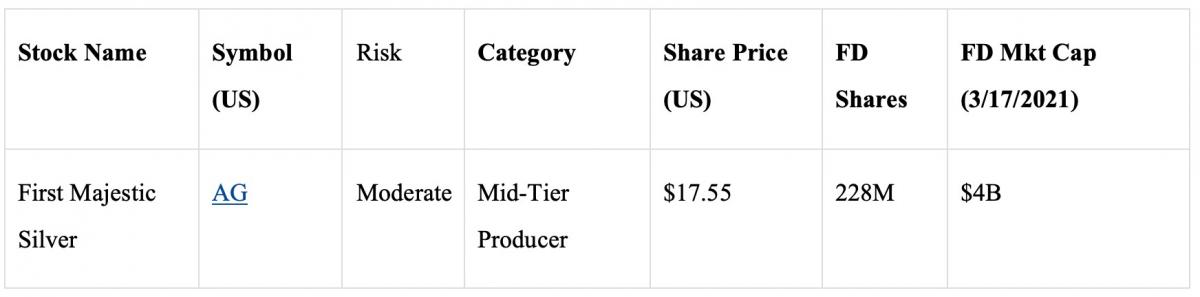

First Majestic Silver

Description

First Majestic Silver (FM) is a large silver producer in Mexico. Until recently they were a very strong company with a clean balance sheet and low costs. Now they have $138 million in debt and lost money last quarter, although they do have $95 million in cash. Their all-in costs are around $17 per oz. (silver equivalent). Hopefully, that will drop when their next quarter financials are released.

They will produce about 22 million oz. of silver equivalent in 2020 (100% of their revenue comes from silver and gold). With this much production, they have huge leverage for higher silver and gold prices. They have 3 producing mines in Mexico.

They have the potential to create over $1 billion in free cash flow at $100 silver prices. At a 10x free cash flow valuation, FM should be worth at least $10 billion at $100 silver. That is my expectation as long as Mexico doesn't increase taxes and royalties, and FM hits their production and cost targets.

One red flag for this stock is their resource total. They only have about 150 million oz. (silver equivalent) of reserves. That seems like a lot, but they plan to increase production beyond their current 22 million oz. (silver equivalent) per year. That is only about 7 years of current reserves. Thus, maintaining production could be an issue down the road and could hurt their share price. After all, there are not very many large silver mines left to develop, but they do have 4 development projects plus 26 drilling rigs looking for another large mine.

The good news is they want to become the world's largest silver miner. That is an aggressive goal. They have will need to get lucky with exploration and acquire a few projects. With that aggressiveness, I would expect this company to do well. If they can grow their resources and production, then my future valuation for them (around $10 billion) is too low. In fact, if quality silver producers are valued at 15x or 20x free cash flow, then FM will be a 5+ bagger.

Note: FM has a large potential tax liability from their Primero acquisition and the way the silver stream is taxed (from 2010 until current). On their most recent MDA on Sedar.com, they list a potential $185 million tax liability and that it does not include interest and penalties. Ouch. I doubt they will have to pay the entire amount, but the liability appears to be growing because they have not changed their accounting to match what the Mexican tax authority deems appropriate.

3/15/2021: Made an offer to acquire the Jerritt Canyon mine for $470 million (all-stock deal). It is a 110,000 oz. producer with 1.2 million oz. of reserves. They paid about 15x free cash flow, which I thought was pricey. Plus, this will change their strategy from being a silver-focused producer. For this hefty price tag, they must think they can increase production and lower costs at Jerritt Canyon. It will add free cash flow, but it’s not the direction I wanted to them go.

Details

Mine Locations: Mexico

Cash: $232 million

Debt: $138 million

Breakeven Costs Per Oz. (current/future): $16/$17

Current Free Cash Flow: $158 million

Current Free Cash Flow Multiple vs FD Mkt Cap: 25

Future Silver Reserves: 350 million oz. (250 gpt.)

Future Silver Production: 30 million oz.

Future Free Cash Flow ($100 silver): $1.5 billion

Future Silver Oz. / FD Mkt Cap: $11

Future Mkt Cap Growth ($100 silver): 225%

Upside/Downside Rating: 2.5/3

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 8.5

Costs/Grade/Economics: 7.5

People/Management: 9

Cash/Debt: 8

Location Risk: 7

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 7.5

Overall Rating: 7.5

Detail/Scorecard Comments

I was shocked by their acquisition of Jerritt Canyon. It made no sense to me. That said, they still have excellent properties, costs, and management. They will be a high-flyer at higher silver prices.

Strengths: Economics, properties, management.

Weaknesses: Location risk in Mexico, somewhat low resources for their long-term production goals.

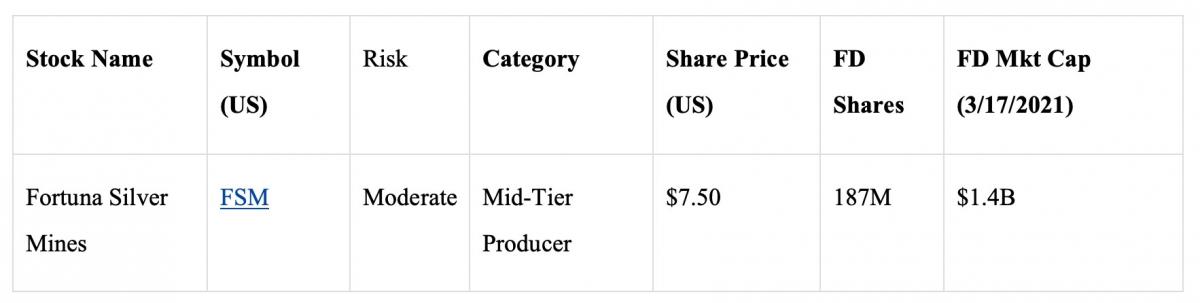

Fortuna Silver

Description

Fortuna Silver is a mid-tier producer in Mexico, Peru, and Argentina. They produce silver, gold, and base metals. In fact, they have 1 mine for each. San Jose in Mexico is a silver mine (8 million oz. of annual production), Caylloma in Peru is a base metals mine (mostly zinc and lead) with 1 million oz. of silver, and Lindero in Argentina is a large gold mine.

They acquired Goldrock Mines in 2016, and their 2 million oz. Lindero gold project. This will give them an additional 100,000 oz. of gold production with cash costs around $700 per oz. (starting in Q1 2021).

It seems like all of the silver miners are building gold mines, and now Fortuna has joined the trend. They will likely change their name in 2021. They should have slightly more revenue for gold than silver, unless silver prices outperform gold.

They have about $85 million in cash and $133 million in debt. They added the debt to build Lindero. Historically, they don't like debt and will pay it back quickly. Their only red flag, besides not being cheap, is future growth. With only 75 million oz. of silver resources (150 gpt.) and 2 million oz. of gold, they need more resources to keep up their growth pace.

The key for this company is going to be exploration or perhaps acquisitions. They have 9 exploration projects on their two large properties: Caylloma in Peru and San Jose in Mexico. They have a new high-grade discovery (Trinidad North) that looks exciting

Details

Mine Locations: Mexico, Peru, Argentina

Cash: $85 million

Debt: $133 million

Breakeven Costs Per Oz. (current/future): $14/$17

Current Free Cash Flow: $100 million

Current Free Cash Flow Multiple vs FD Mkt Cap: 13

Future Silver EQ Reserves: 125 million oz. (150 gpt.)

Future Silver EQ Production: 15 million oz.

Future Free Cash Flow ($100 silver): $550 million

Future Silver EQ Oz. / FD Mkt Cap: $11

Future Mkt Cap Growth ($100 silver): 300%

Upside/Downside Rating: 2.5/3

Scorecard (1 to 10, with 10 being the best)

Properties/Projects: 7.5

Costs/Grade/Economics: 7.5

People/Management: 7.5

Cash/Debt: 7.5

Location Risk: 6.5

Risk-Reward: 7

Upside Potential: 7

Production Growth Potential/Exploration: 7

Overall Rating: 7

Detail/Scorecard Comments

They are currently valued at a 13 free cash flow multiple, which is below their peers. The reason why is their relatively low resources for their market cap and the locations of their mines.

Strengths: Economics, properties, management.

Weaknesses: Location risk in Mexico, Peru, Argentina. Somewhat low upside potential. Somewhat low resources.

Conclusion

These are my favorite silver miners for 2021. I’m sure they won’t all perform well, but hopefully, most of them will. The key will be the silver price and how management teams execute. Hopefully, silver will remain above $25 and trend higher in 2021. Once we get above $30, the silver miners should be flying and producing significant free cash flow. This particular group should be part of the high-flyers because of their quality and leverage to higher silver prices.

GSD Ratings

For more insights visit Don’s website Gold Stock Data.

Disclosure: I am/we are long AXU, AUNFF, CDE, EXK, FSM, AG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article

*********