Silver Speculators Reduced Their Bearish Bets For Fourth Week

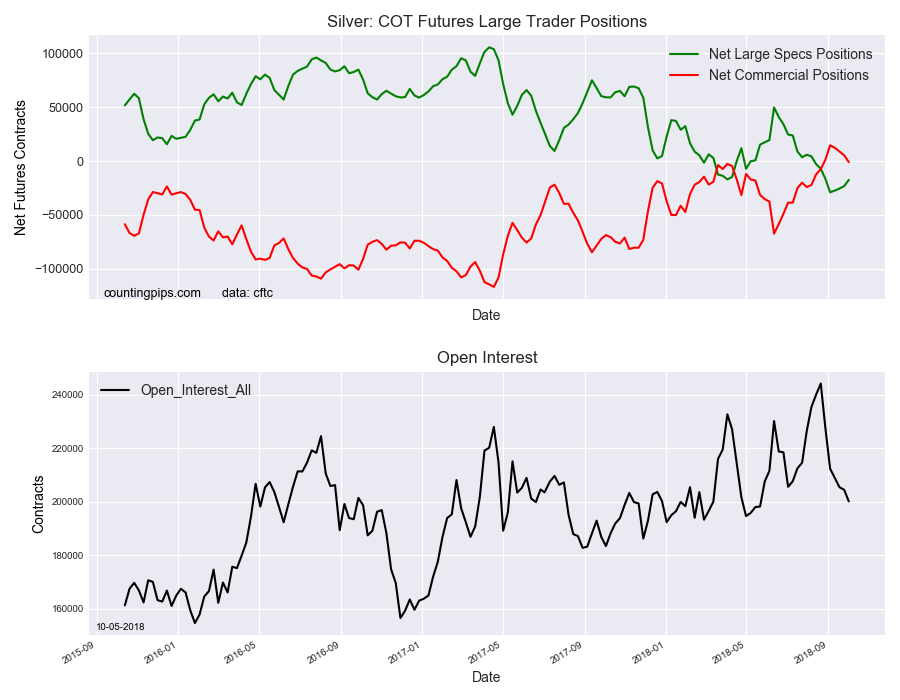

Silver COT Futures Large Trader Positions

Silver Non-Commercial Speculator Positions

Large precious metals speculators cut back on their bearish net positions in the Silver futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Silver futures, traded by large speculators and hedge funds, totaled a net position of -17,498 contracts in the data reported through Tuesday October 2nd. This was a weekly gain of 5,757 contracts from the previous week which had a total of -23,255 net contracts.

The speculative bearish position has now declined for four straight weeks after having risen for the previous five weeks in a row. Overall, the silver speculator position has now been in bearish territory for eight consecutive weeks but has now fallen below the -20,000 contract threshold for the first time in the past five weeks.

Silver Commercial Positions

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -1,012 contracts on the week. This was a weekly drop of -6,398 contracts from the total net of 5,386 contracts reported the previous week.

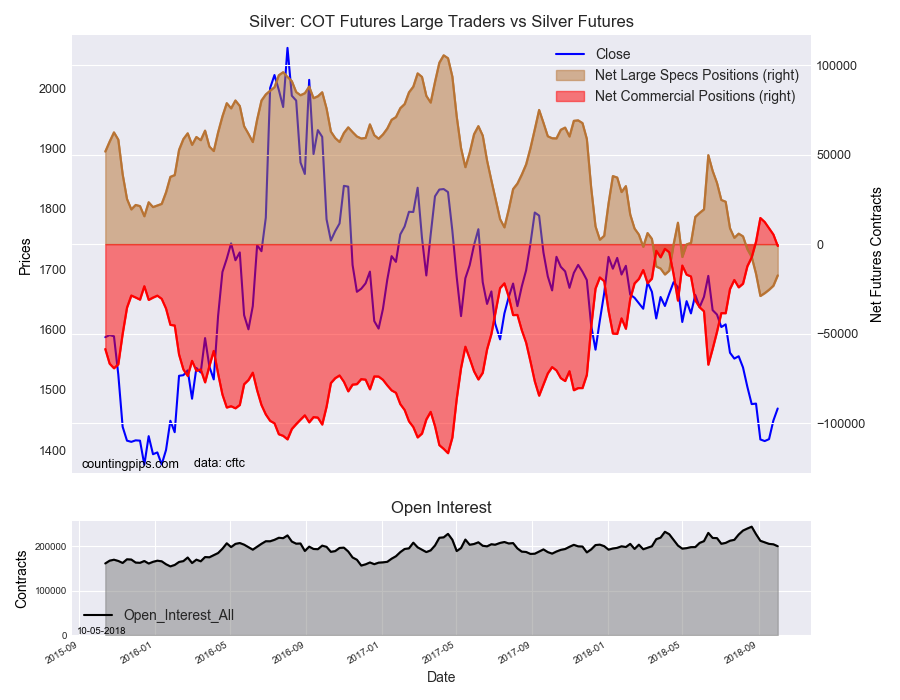

Silver COT Futures Large Trader Vs Silver Futures

Silver Futures

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Silver Futures (Front Month) closed at approximately $1469.30 which was an advance of $20.00 from the previous close of $1449.30, according to unofficial market data.

*********