The Tiny Breakdown in Silver Could Lead to Big Moves

It’s another up day in the USD Index and another down day in precious metals and copper. But that’s just the start.

My today’s premium Gold Trading Alert covers many markets, but in this free analysis, I’ll focus on silver, copper, and world stocks. It all has implications for gold and mining stocks, anyway.

Is This the Start of Something Big?

Let’s start with the white precious metal that often drives sentiment to red-hot levels, especially in the case of individual investors.

Silver price broke below its rising support line based on the April and May lows, and it looks like the breakout will hold this time.

A few days ago, the breakout was immediately invalidated, but this time, silver is staying below the support line.

USD’s support (its own breakout) makes the pro-bearish scenario here more likely this time.

Let’s keep in mind that the above is just a short-term phenomenon, and silver’s long-term breakdown is where the real action will begin.

I mean the most likely upcoming move below the rising, dashed support line based on the 2020, 2022, and 2023 lows.

Remember when silver broke below a similar line in 2012? It then quickly dropped below $20. Interestingly, that decline started from the same (nominal) price levels that we have right now.

Why would silver decline here? Most likely the rising USD Index is one major thing, but another reason is silver’s industrial usage. This is great when the world economies are growing, but not so good if they are about to decline or grow at slower pace due to trade limitations.

Did silver have multiple industrial uses at the 2008 top? Yup.

Did it slide, nonetheless? Also, true.

The main difference between both cases is that now silver is after a rally that’s not as steep, and it’s more vulnerable technically – it failed to rally above the 61.8% Fibonacci retracement based on the 2011 – 2020 decline. Technically, the rally from the 2020 low is just a correction of the 2011 – 2020 slide.

Is the silver market near its breaking point? Will the manipulated (“manipulated”?) price finally break free and soar? Is it inevitable and prices are NOW on the verge of jumping to three digits?

Perhaps.

But I’ve been reading all the above since I first got interested in this market in 2002. During this time, silver rallied, and it declined just like any other commodity. What are the reasons for silver to soar now that at the same time were not valid a year ago, five years ago, ten years ago and fifteen years ago?

If there are none as it was all up-to-date also back then, then perhaps those reasons are good reasons for silver to rally eventually (!!!), but not necessarily now or in the following months.

Yes, I do think that silver will soar in the following years (to the benefit of those with it in their retirement accounts), but I also think that it will decline in the following weeks and months.

Copper jumped higher recently after the tariffs were hiked (at least in theory) for the EU, but I warned that this was unlikely to last and that it was likely to be followed by declines.

That’s what copper has been doing recently – it moved back below its rising support line, and it invalidated the breakout above its 61.8% Fibonacci retracement level.

The implications are bearish.

Trade With China Still Stagnant

Another bearish sign comes from the “real world” (as if charts were not real). I mean the situation regarding trade with China. Quoting from Yahoo!Finance:

“As Apollo Global Management chief economist Torsten Sløk pointed out this week, there are still no signs of a rebound in trade between the US and China. Two weeks after the tentative trade deal, container traffic hasn’t strongly returned, he said, suggesting the existing tariffs are still too high, or that US companies are holding out for potentially better tariff conditions to emerge.”

So much for the improvement in the U.S. – China trade situation.

The reality hasn’t hit hard enough for the investors to care… Yet. The statistics don’t show the changes – yet. But when they do, the markets could tank fast.

Remember the 2020 slide? It wasn’t until the jobs report showed how bad the situation was that the markets plunged.

Sooner or later (likely sooner), the statistics will show the economic slowdown and investors will catch up. Some people will sell. More people will notice and sell as well – and so, it will begin.

The impact on commodities and mining stocks should then be really significant.

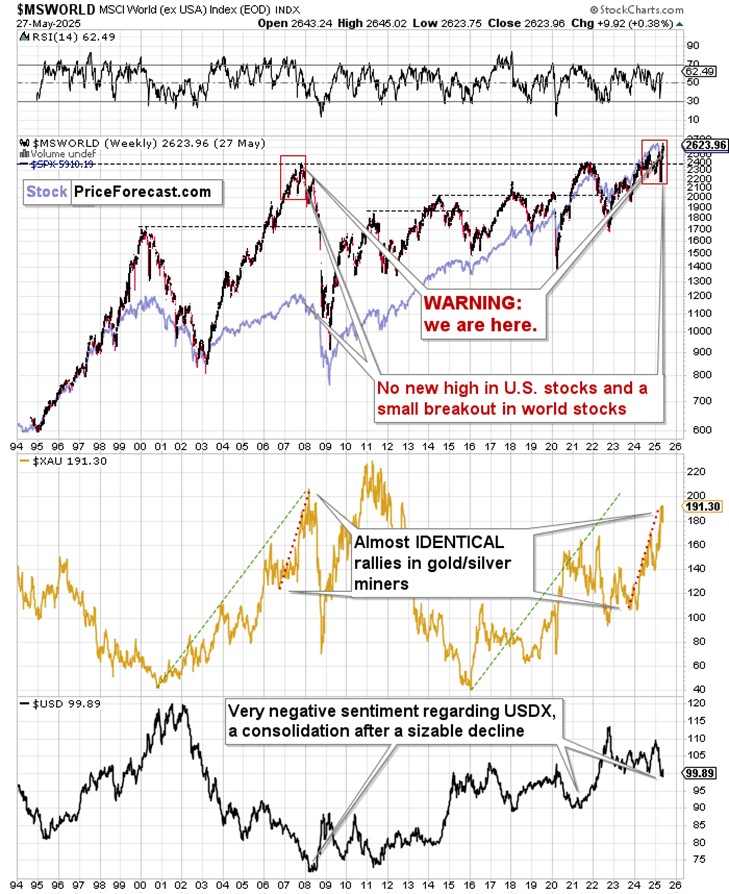

Before summarizing, I’d like to remind you about the similarity in the U.S. stocks relative performance compared to other world stock indices – between now and 2008.

The U.S. stocks failed to move to new highs, while other stocks broke higher. All this while the sentiment for the USD Index is very negative and the price appears to have bottomed.

Declining world trade, lower GDP growth (or economic contraction) and lower commodity prices are all aligned. And history shows that mining stocks are likely to be affected to a big extent as well (gold, too, but not as much).

If stocks are about to collapse (in the following weeks/months), then the impact on multiple markets (especially on silver, copper, and mining stocks) is going to be enormous.

And we are prepared to take advantage of it.

Thank you for reading my today’s analysis – I appreciate that you took the time to dig deeper and that you read the entire piece. If you'd like to access my complete premium analysis, including specific technical price targets and comprehensive portfolio insights, consider subscribing to my Gold Trading Alerts or – if you want the best – our Diamond Package. If you’re not ready to subscribe yet, I invite you to stay updated with our free analyses - sign up for our free gold newsletter now.

********