The Ultimate Stablecoin

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year.

Back in those halcyon days, volatility was deemed to be a feature. That is, volatility in the upward direction was loved by everyone who said that bitcoin is money, in their desire to make money. In the first instance of the word, the term money refers to bitcoin. In the second, it refers to the dollar. The same problem we see with gold:

-

bitcoin is money

-

bitcoin is going up

-

buy bitcoin now

-

sell bitcoin later at a higher price

-

to make money

From what we remember from a logic class in the philosophy department back in university (in the halcyon days long before the halcyon days of bitcoin skyrocketing), there may be a fallacy or two in here that have Latin names.

Anyways, in our bitcoin articles, we were careful not to get into the game of setting price targets. We didn’t know (and no one else did either, as it turned out) where the price would go. Other than, we did say that bitcoin has no firm bid and its price will drop when the speculators turn. Bitcoin had just hit $3000 when our series began. We were careful to say that the price could go a lot higher, and we made no prediction as to how high or when it would turn.

We added one more article on December 10. That turned out to be days before the top, though we didn’t know it at the time. Neither did those presuming to give you financial advice, telling you to buy it. We didn’t call the top (the article was an argument that gold is money because its marginal utility does not decline).

In today’s article, we are not just trying to say “we told you so.” We have a point to make. We want to revisit bitcoin in light of an interesting development.

The Ultimate Stablecoin

This week, bitcoin fell hard. It closed last week around $6,400. And this week, it was around $5,400. This is $1,000 in a week, or about another 15%. That is on top of the epic drop from its high near $20,000 set about 11 months ago.

When bitcoin was rising, its volatility was a feature. But once it began falling, then this feature became a bug. Probably for this reason, there has been the rise of so called stablecoins. Tether, the most prominent, is tied to the pseudo-stable dollar.

And, though they are generating much less buzz (for now), there is a better class of stable crypto currencies, which are redeemable in gold (e.g. Digix Gold) or even gold legal tender coins (e.g. Quintric). We like to think we helped kick off the concept with our piece in April 2013, where we said:

“The time may not be right yet, but we would love to see a similar technology to provide a gold-redeemable cryptographic based currency. “BitGold” would not be based on the labor theory of value (i.e. “mining” to generate new coins), the quantity theory of money (i.e. absolute cap on the quantity of coins). It would not be plagued by a ridiculous bid-ask spread. In short, it would behave as dollar bills did before the advent of the Fed. Arbitrage would set the value of BitGold…”

We like to think of things in terms of preferences. We ask the question what would happen in the following scenario. Suppose investors can buy one of two different bonds from the same issuer, each subject to the same credit risk, and the same maturity. The only difference is that one promised to pay $120,000 in 2028, but the other promised 100 ounces of gold. Given this simple choice, we are confident that many will choose the gold.

Similarly, if savers had a choice between the irredeemable bitcoin and a gold-redeemable coin, assuming equality utility, security, indelibility, etc., which would they choose? And now with bitcoin falling, it’s obvious.

There’s just one little problem with gold redeemable crypto currencies.

Making Gold Cryptocurrencies Work

There is a cost to store and administer the gold. So there are three conventional ways that an issuer can cover this cost. One is simple enough. Charge for storage. Digix, for example, charges 60bps per annum. That works for the company, but of course to the saver it’s negative interest. Saving becomes a Sisyphean task (as we wrote about the Swiss franc) when there is a constant drip-drip-draining away of your savings. No one would choose to pay 60bps per year unless they are expecting big capital gains (in dollars).

The Second is to charge for transactions. Digix also levies a 0.13% fee on all transfers. That may not seem like a lot, but it is a form of friction that will inhibit circulation. And there is another problem with it, at least for those companies who rely on it. We’ll get to that in our discussion of the third method of charging.

Issuers can charge a markup when people buy the gold in their system, and a markdown when they sell. This is subject to the same problem as the transaction fee.

The issuer is betting that transaction volume will be at least a certain percentage of total gold in storage. This is because they are paying the cost of the latter, by charging fees on the former. It is a bet on a low stocks-to-flows ratio (or high flows-to-stocks, if you prefer). We don’t really like a business model that is based on making such bets.

So does that leave us with negative interest on gold deposits?? No, and to see why we need to look at gold currency back in the time of the classical gold standard of the 19th century. And we need to think of this from the point of view of the banks.

Bank notes were convenient: not subject to wear and easier to carry compared to gold coins, and available in more convenient denominations. But why would banks offer this service? How did they make money from it?

Banks did not issue notes only to put gold into a warehouse, incurring costs to store, insure, and administer it. They had no way to charge for storage. If the bank issued a $20 bill, it had to promise to redeem it for one ounce of gold (it was actually 0.9675oz but we want to keep this simple), whether the next day or the next decade.

And obviously they had no way to charge for transactions. The bank did not know or control if you paid that bill to Andy who paid it to Bob, who gave it to his son Charlie, who paid it to Donny, who gave it to Erica, etc.

Of the conventional options, that would leave only charging for deposit and withdrawal. That is, you bring in more than a dollar’s worth of gold to get a dollar-redeemable bill. And/or when you redeem, you get less than a dollar’s worth of gold. The banks could have tried this, but no one would have agreed to it.

Also, if you want circulation, you can’t impose such frictional costs. Think of it as a bid-ask spread, when you give up your gold to get paper, you get a bit less paper than the gold you gave(!) And vice versa, when you give up your paper to get back your gold, you give up more paper to get the same gold.

Money must be the most marketable commodity. The wider the spread, the less marketable. Historically, we know there was no spread on gold-redeemable currency.

To understand how the banks could offer this service for free, we need to introduce a paradigm shift. Paradigm shifts can be explained easily (e.g. at Keith’s last company, DiamondWare, the technology was called “3D voice”). But to really get your arms around it, takes effort and time.

Banks issue notes to raise capital.

Gold stored in a vault has no utility, as Warren Buffet pointedly reminds us. No bank issued notes to put gold into a vault.

Banks issued notes to raise capital to invest in an asset that paid a yield. In the 19th century, financial instruments were denominated in gold and paid their yields in gold. Whereas today, nearly everything is denominated in dollars and pays a dollar yield. Even the gold forward curve is a dollar yield on dollars, which happens to use gold (i.e. start with dollars, buy gold and sell gold forward, pocketing the basis spread).

The business model of note issuance was simple, and clear. Banks took gold, issued a note, and invested the gold. They paid nothing on the notes, but earned something on the assets they bought (i.e. bills of exchange). This was a simple, boring, and safe business.

Today, there is no bills market. Alas, like so much else, it was destroyed in the wake of the Great War (disclosure: Monetary Metals is developing a market for yield on gold). But there is a more fundamental problem.

Did we mention the paradigm shift that’s necessary? Did we say it’s hard for people to get their arms around? Today, many think of gold in terms of rising price (or hoped-for rising price), of a gold account in terms of spending at higher prices (i.e. free money). And, of course, all Right Thinking People are against that fractional reserve bankster scam...

That leaves them paying for storage, depositing, withdrawing, and transacting. Which is great if the purpose is for speculation. Or else, it leaves the issuer taking the risk of low transaction volumes, which is not good for anyone.

A yield is the foundation of the gold standard, if gold is to circulate. It enables zero spread, zero storage costs, and zero transaction costs. And it does not put the issuer at risk, based on assumptions that may or may not be true.

Gold was back then, and still is now, the best backing and best thing which people can redeem their currency for. Back then, currency was paper because that was what was possible with 19th century technology.

Today, not only will people not be carrying around gold coins (on the rope belt they are not wearing to tie the sack cloth robe they don’t walk around the streets in). They won’t be carrying pieces of paper either. Nor likely even old school credit cards. It will be an app on the phone.

Crypto currency is a great fit for such an app. Crypto backed by gold is a better stable coin than crypto backed by dollars. And crypto backed gold is the ideal, because it will be a free service for users.

*********

This Report was written from Zurich. Keith is also visiting Hong Kong, Singapore, Sydney, and Auckland. If you would like to meet, please contact us.

Supply and Demand Fundamentals

The prices of the metals rose, gold +$11 and silver +$0.25.

The question on everyone’s mind (including ours) is: what will cause a change in the gold price trend, or what will make gold go up in a large and durable way? And that leads to another way of looking at this question.

Price is set at the margin.

We have covered several times Warren Buffet’s pointed (and disingenuous) comment that gold has no utility. It just sits, and there is a cost for it to sit. And an opportunity cost.

So why do people buy something which has no utility and no return? One, which we discuss a lot, is speculation. They buy whatever’s going up, in an attempt to cash in on the rise. So let’s not dwell on this.

A second reason is fear of counterparty default. Third, is gold is a non-expiring hedge for monetary collapse and/or a currency regime change. This is a broader version of simple counterparty default.

Right now, General Electric is in the news. Its investment grade rated bonds are trading like junk bonds. This is like an echo from the past. Bear Sterns retained its investment-grade rating until just before its demise.

GE has about $115 billion in debt. If it defaults, that could put fear into a lot of investors. They will certainly buy Treasury bonds (which are defined as risk free). Will they buy gold, which is the only financial asset which is truly free of default risk? Maybe.

However, in addition to GE we know that a significant fraction of bonds out there are issued by so-called zombie corporations, whose profits are less than interest expense. Rising interest rates can only have increased the percentage, though the increased cost kicks in with a lag (as each bond matures and must roll). In addition to the problem of rising default risk from these companies, there is the risk if enough hits at once, that the credit market they depend on, goes no bid again as it did in 2008.

Of course, if their bonds are impaired then their equities are worthless. Stocks will be crashing in this scenario.

We raise the issue of price being set at the margin to make a point. In this scenario, the marginal buyer of gold will not be the speculator. It will be the mainstream investor who is desperate to protect himself from a financial system going mad again.

When will this happen? Watch for news of GE and other major debtors sinking deeper into trouble.

As to systemic default risk, i.e. monetary collapse, it’s early yet. There are some peripheral currencies like the bolivar and lira that could go away soon. But their troubles are widely known, and visible far in advance. We would not expect their demise to have much impact on the world’s monetary order (though of course it is horrific for the people who live in Venezuela and Turkey).

Other currencies are also in trouble—we have written a lot about the franc. It is impossible to predict the timing of such a thing, though our gut feeling is that it is still a ways out.

As to the de-dollarization, loss-of-reserve-status, end-of-petrodollar, gold-backed-yuan, SDR-to-replace-USD ideas, we say: rubbish. The dollar will get stronger from here, if not in terms of gold then as measured by other currencies. Panicky people in Istanbul do not think “let me buy Brazilian reals, Russian rubles, Indian rupees, and Chinese yuan" because someone coined the glib term “BRICs”. They do not think “I will buy me some Saudi riyal because, petro.”

They buy USD.

So we end on a conclusion we have reiterated many times. When gold goes to $10,000 it is not gold going up. It is the dollar going down.

It is inevitable that the dollar will go down. Keith just gave a talk at an Austrian economics conference in Madrid “There Is No Extinguisher of Debt” (paper to be published soon). The collapse of the dollar is baked into the mathematics.

People could buy gold today at an 88% discount from that price. But do yourself a favor. Watch any politician on TV. Watch a Republican promise to “grow our way out of the debt”. Or watch a Democrat promise a free university education to everyone. Watch even many libertarians promote a Universal Basic Income(!)

If you think they don’t understand, you are right. But the vast majority of voters support these politicians. The voters, too, don’t understand. And the investors too.

Buying gold is a non-expiring hedge. But only people who perceive a need to hedge, will buy the hedge. The rest may think that stocks are a bargain here, being down almost 7% from the high last month. So far in this incredible boom following the crisis, every time people who bought the dip were rewarded.

Are we getting close to the point where it won’t be? If GE is any indication, if GE will have a contagion effect (remember that word?) then the answer is likely yes.

Now let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell this week.

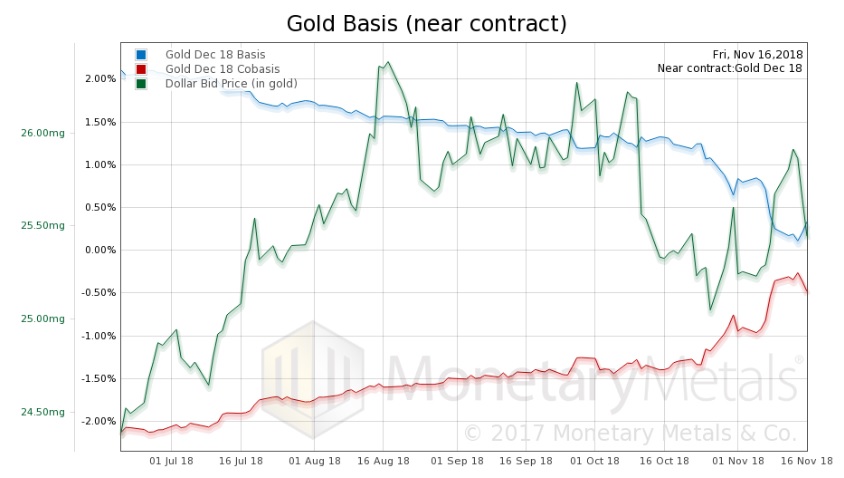

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

A drop in the dollar (i.e. rise in the price of gold) and we see the scarcity of gold (i.e. cobasis) drop. There was buying of futures and some physical metal.

The Monetary Metals Gold Fundamental Price rose $9, $1,314 to $1,323.

Now let’s look at silver.

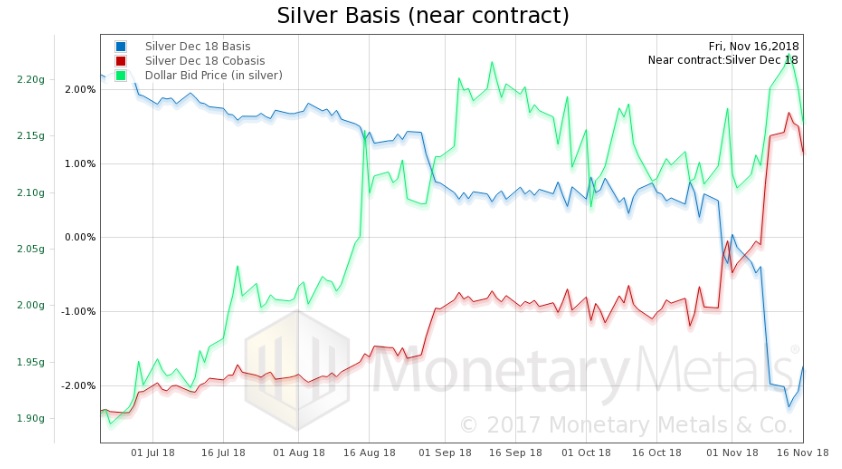

Keep in mind the approaching First Notice Day of the December contract. So after the big spike up in the cobasis last Friday, this week it’s down with the price of the dollar, measured in silver (i.e. rising silver price).

The Monetary Metals Silver Fundamental Price fell another 17 cents, to $15.05.

© 2018 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the Gold Standard Institute USA. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. His website is

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the Gold Standard Institute USA. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. His website is