Silver Price Forecast: Fear May Drive Silver More Than 60% Higher In 2022

As the US and global markets rattle around over the past 60+ days, many traders have failed to identify an incredible opportunity setting up in both Gold and Silver. Historically, Silver is extremely undervalued compared to Gold right now. In fact, Gold has continued to stay above $1675 over the past 12+ months while Silver has collapsed from highs near $30 to a current price low near $22 – a -26% decline.

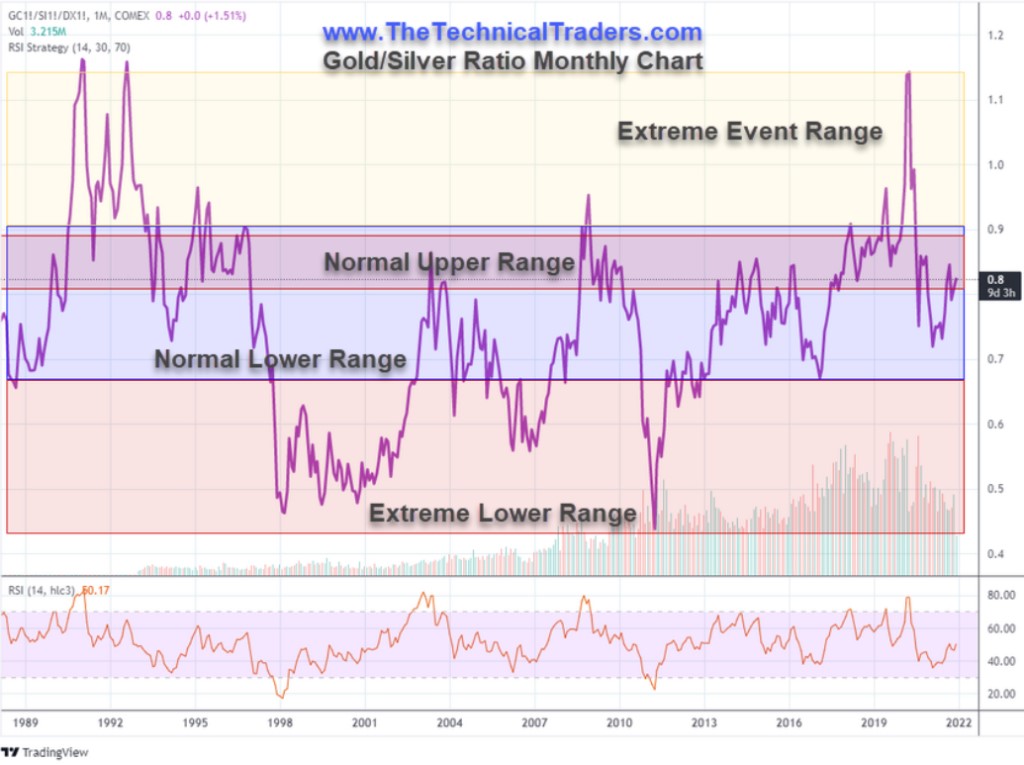

Many traders use the Gold/Silver Ratio as a measure of price comparison between these two metals. Both Gold and Silver act as a hedge at times when market fear rises. But Gold is typically a better long-term store of value compared to Silver. Silver often reacts more aggressively at times of great fear or uncertainty in the global markets and often rises much faster than Gold in percentage terms when fear peaks.

Understanding the Gold/Silver ratio

The Gold/Silver ratio is simply the price of Gold divided by the price of Silver. This creates a ratio of the price action (like a spread) that allows us to measure if Gold is holding its value better than Silver or not. If the ratio falls, then the price of Silver is advancing faster than the price of Gold. If the ratio rises, then the price of Gold is advancing faster than the price of Silver.

Right now, the Gold/Silver ratio is above 0.80 – well above a historically normal level, which is usually closer to 0.64. I believe the current ratio level suggests both Gold and Silver are poised for a fairly big upward price trend in 2022 and beyond. This may become an exaggerated upward price trend if the global market deleveraging and revaluation events rattle the markets in early 2022.

Sign up for my free trading newsletter so you don't miss the next opportunity!

I expect to see the Gold/Silver ratio fall to levels below 0.75 before July/August 2022 as both Gold and Silver begin to move higher in Q1:2022. Some event will likely shake investor confidence in early 2022, causing precious metals to move 15% to 25% higher initially. After that initial move is complete, further fallout related to the deleveraging throughout the globe, post-COVID, may prompt an even bigger move in metals later on in 2022 and into 2023.

COVID Disrupted The 8~9 Year Appreciation/Depreciation Cycle Trends

In May 2021, I published an article suggesting the US Dollar may slip below 90 while the US and global markets shift into a Deflationary cycle that lasts until 2028~29 (Source: The Technical Traders). I still believe the markets will enter this longer-term cycle and shift away from the broad reflation trade that has taken place over the past 24+ months – it is just a matter of time.

If my research is correct, the disruption created by the COVID virus may result in a violent reversion event that could alter how the global markets react to the deleveraging and revaluation process that is likely to take place. I suggest the COVID virus event may have disrupted global market trends because the excess capital poured into the global markets prompted a very strong rise in price levels throughout the world in real estate, commodities, food, technology, and many other everyday products. The opposite type of trend would have likely happened if the COVID event had taken place without the excessive capital deployed into the global markets.

Demand would have diminished. Price levels would have fallen. Demand for commodities and other technology would have fallen too. That didn't happen. The opposite type of global market trend took place, and prices rose faster than anyone expected.

Markets Tend To Revert After Extreme Events

As much as we may want to see these trends continue forever, any trader knows that markets tend to revert after extreme market trends or events. In fact, there are a whole set of traders that focus on these “reversion events.” They wait for extreme events to occur, then attempt to trade the “reversion to a mean” event in price action.

My research suggests the COVID virus event may have created a hyper-cycle event between early 2020 and December 2021 (roughly 24 months). My research also suggests a global market deleveraging/revaluation event may be starting in early 2022. If my research is correct, the recent lows in Gold and Silver will continue to be tested in early 2022, but Gold and Silver will start to move much higher as fear and concern start to rattle the markets.

As asset prices revert and continue to search for proper valuation levels, Gold and Silver may continue to rally in various phases through 2028~2030.

Initially, I expect a 50% to 60% rally in Silver, targeting the $33.50 to $36.00 price level. For SILJ, Junior Silver Miners, I expect an initial move above $20 (representing a 60%+ rally), followed by a follow-through rally targeting the $25.00 level (more than 215% from recent lows).

I believe the lack of focus on precious metals over the past 12+ months may have created a very unusual and efficient dislocation in the price for Silver compared to Gold. This setup may present very real opportunities for Silver to rally much faster than Gold over the next 24+ months – possibly longer. If my research is correct, the Junior Silver Miners ETF, SILJ, presents a very good opportunity for profits.

Want to learn more about the movements of Gold, Silver, and their Miners?

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

If you need technically proven trading and investing strategies using ETFs to profit during market rallies and to avoid/profit from market declines, be sure to join me at TEP – Total ETF Portfolio.

Pay particular attention to what is quickly becoming my favorite strategy for income, growth, and retirement - The Technical Index & Bond Trader.

Have a great day!

Chris Vermeulen

Chief Market Strategist

********