Silver Forecast 2015 And Beyond

Recently I authored an article whereby using technical analysis, I uncovered a potential Silver price target of $300.00 an ounce. Since then I’ve been asked to investigate and support how Silver may get to such a lofty price…and or do I believe it’s even possible?

Recently I authored an article whereby using technical analysis, I uncovered a potential Silver price target of $300.00 an ounce. Since then I’ve been asked to investigate and support how Silver may get to such a lofty price…and or do I believe it’s even possible?

Here are some of the facts and fundamentals I’ve found regarding Silver:

- Silver is a precious metal grouped with the likes of Gold and Platinum

- Silver has the highest electrical conductivity of any element

- Silver has the highest thermal conductivity of any element

- Silver has the highest reflectivity of any metal

- Silver is rare, with a naturally occurring “abundance in the earth’s crust” at just .075 ppm…whereas Gold occurs at .004 ppm (roughly a 19 to 1 ratio). Aluminum occurs at 82,300 ppm as a reference

- Silver production was 870 million ounces in 2013 vs. Gold production at 107 million ounces, an 8 to 1 ratio.

- Silver demand hit a record high of 1,081 million ounces in 2013

- Silver uses include Electronics, medical applications, water purification, batteries, solar technology, industrial catalysts, nanotechnology and photography. It’s incredible just how critical this precious metal is to industry.

I’d like to encourage everyone to research the uses of silver for themselves, as I couldn’t possibly fit it all into one Silver Price Forecast.

Recently I had a conversation with a close friend who’s a Medical Doctor. He and I were discussing the trends in medical marijuana use and its legalization in so many States. Though he doesn’t personally prescribe marijuana as a medicine, he believes there may be medicinal benefits.

I asked how patients receive their medicine -- and does insurance recognize or cover any of the related medical marijuana costs? To the best of his knowledge, he said no and added that retail medicinal marijuana prices can cost upwards of $300 per ounce.

I then thought to myself, “How can society accept someone growing a plant in their basement and selling it for $300 an ounce, but take issue with a strategic PRECIOUS METAL (i.e. Silver) potentially costing the same?

Indeed, yes I firmly believe silver prices could reach the $300 price target previously mentioned.

Below I have attached the CHARTSEEK 2015 and beyond Silver Price Forecasts.

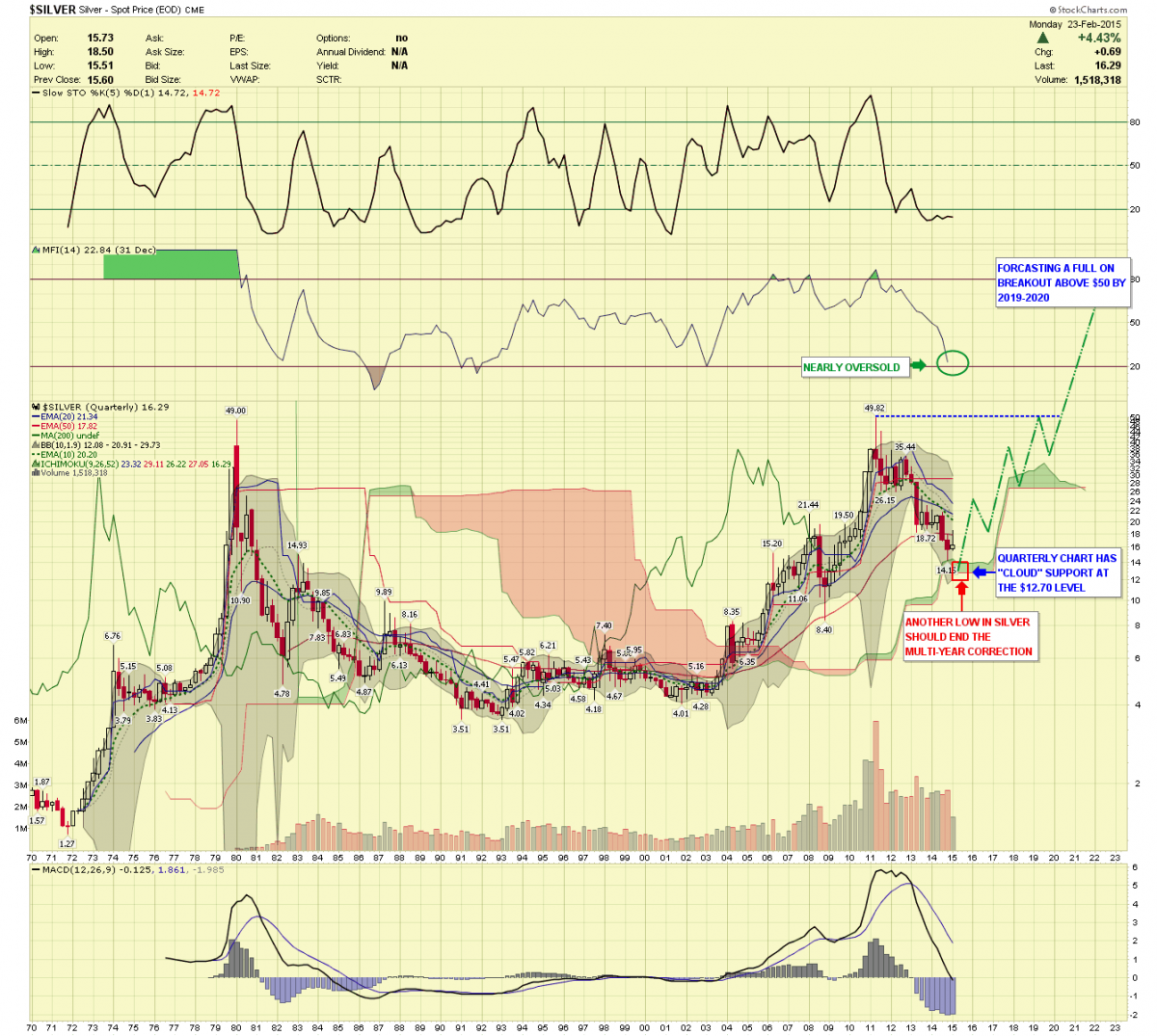

Here is a Yearly chart showing an excellent price support at the 20 period moving average of $12.69 for this year. Notice we are also oversold on the slow Stochastics indicator.

On the Quarterly silver chart, though it’s slightly more cluttered you will see “cloud” support coming in at $12.70 and the MFI (14) is nearly oversold. If we bottom this year, our Silver Forecast is for a full-on breakout above the $50 level by 2019 or 2020.

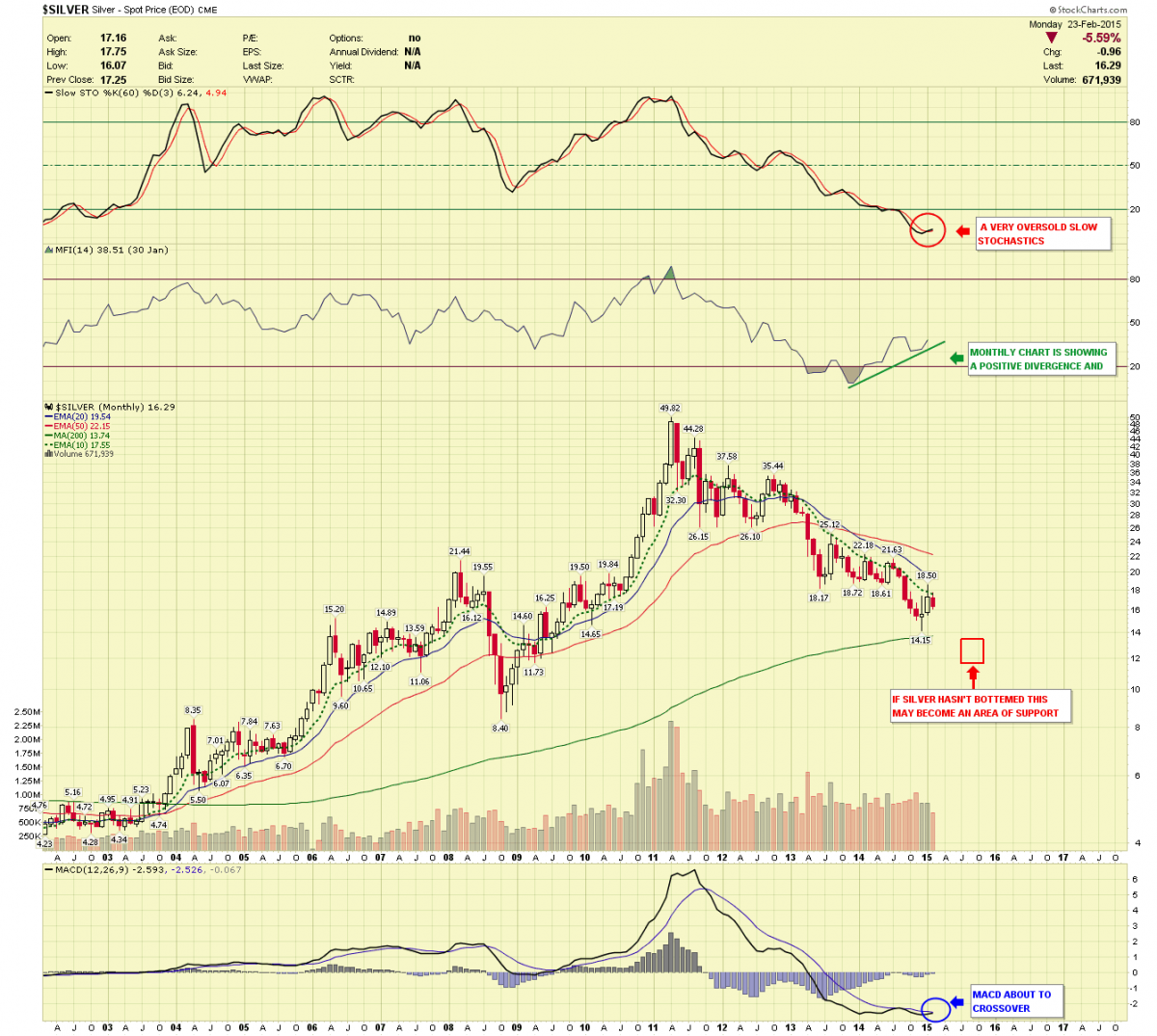

In the Monthly silver chart you’ll see a nice positive divergence building…an MACD nearly crossing over and an extremely oversold slow stochastics. We added our red target box to help illustrate the potential bottoming zone.

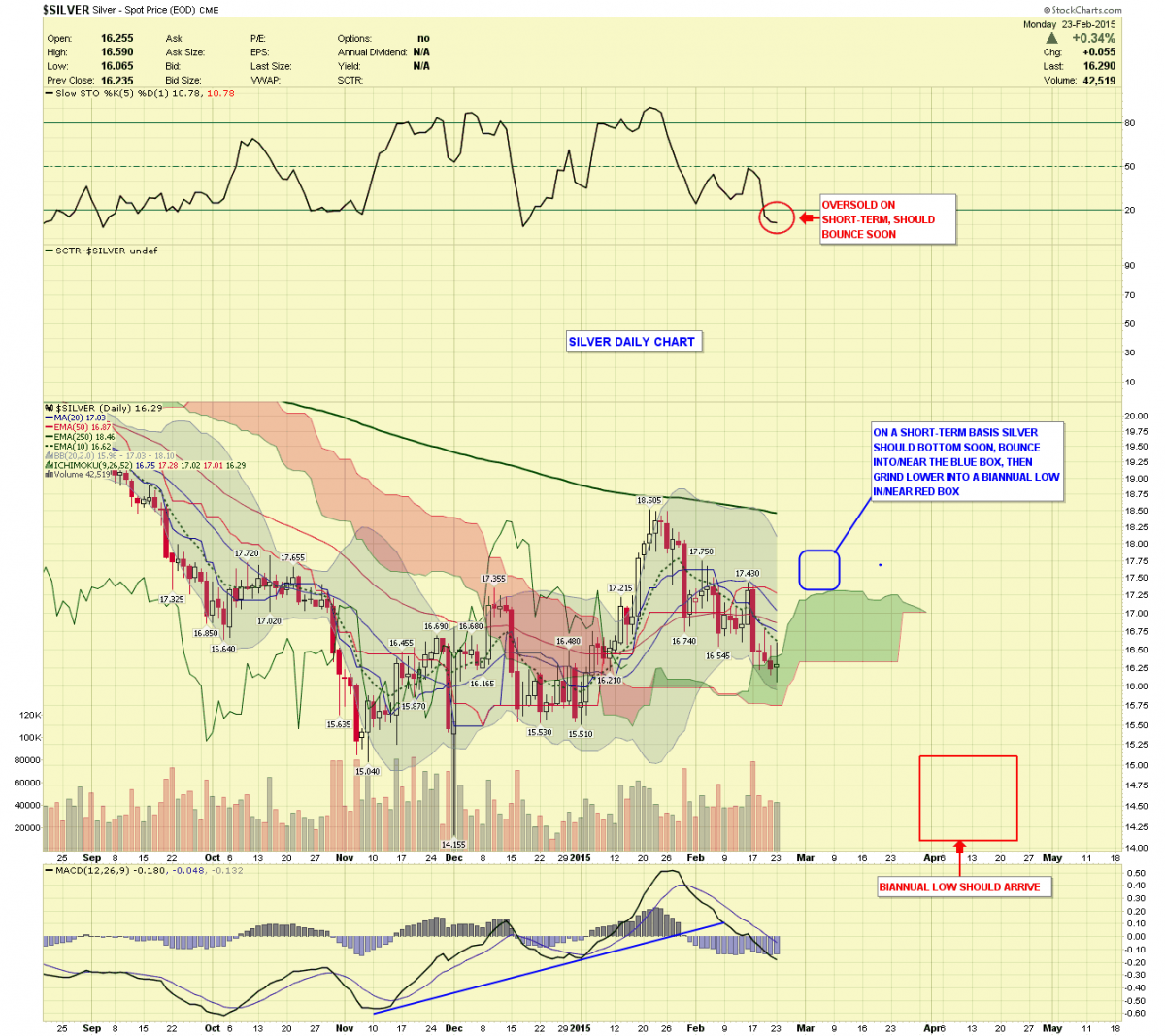

Lastly, we show the Silver Daily chart where we are currently expecting a bounce-up within the next week or two. Then a grind lower into the Biannual Major Cycle Low is due sometime in late March to mid-April.

********

Chartseek will continue to update its subscribers as cycles and targets approach. We would also like to offer a free two-week trial to our basic service.

Trade wise,

Visit Chartseek for more insights: http://www.chartseek.com/services.html